Reserve Bank of Australia Annual Report – 2021International Financial Cooperation

The Reserve Bank participates in international efforts to address the challenges facing the global economy and financial system, and improve the international financial architecture. It does so through its membership of global and regional forums and its close bilateral relationships with other central banks.

Group of Twenty (G20)

Purpose

The G20 is a forum for international cooperation on economic, financial and other policy issues among the 20 largest global economies, including Australia, as well as the International Monetary Fund (IMF) and other international organisations. The G20 was chaired by Saudi Arabia from December 2019 to November 2020, and has been chaired by Italy since December 2020.

Reserve Bank involvement

The Reserve Bank is represented at high-level meetings of the G20 by the Governor and Assistant Governor (Economic), while other senior staff participate in select G20 working groups and contribute to the G20's work on financial sector issues.

The G20 has served as a key forum for members to cooperate in their responses to the COVID-19 pandemic, discuss key risks to the economic outlook and share experiences on economic and financial policy measures. An action plan to support the global recovery through the pandemic was agreed in April 2020 and updated in 2021 to reflect the ongoing impact of the pandemic and the evolving economic outlook. The G20 has also made material progress on developing a common framework to facilitate the restructuring of unsustainable debts owed by low-income countries to official foreign creditors. In April 2021, the G20 agreed to re-establish the Sustainable Finance Working Group, which aims to help mobilise finance to support the goals of the Paris Agreement on climate change. All G20 meetings were conducted via videoconference facilities during 2020/21.

In addition to the meetings of finance ministers and central bank governors and their deputies, Reserve Bank staff participated in three G20 working groups:

- The Framework Working Group has been identifying and monitoring risks to the economic outlook, including the impacts of climate change, as well as considering macroeconomic policy settings.[1] This group also made progress towards exploring policies that productively and inclusively encourage digitalisation in the economy.

- The Working Group on International Financial Architecture has focused on facilitating a temporary suspension of debt repayments by low-income countries to official creditors in the wake of the pandemic. Given the ongoing challenges faced by these countries, the group also worked on a common framework to guide the restructuring of official sector debt for countries facing debt distress. It has also monitored volatility in capital flows in emerging market economies and how countries have responded.

- The Sustainable Finance Study Group was re-established in 2021 and upgraded to a working group with a mandate that includes identifying barriers to sustainable finance. A key deliverable of the group is a multi-year Roadmap for Sustainable Finance – work on the Roadmap in 2021 will focus on climate change. In addition, in 2021 the group will produce reports on the following three focus areas: improving corporate sustainability reporting and disclosure; improving compatibility of approaches to identify, verify and align investments to sustainability goals; and enhancing the role of international financial institutions in supporting Paris climate commitments. In future years, the group will report on progress against the Roadmap, and expand it to cover topics beyond climate change such as broader environmental, social and governance (ESG) issues.

Financial sector issues – in particular, implications of the pandemic – continued to be an important part of the G20's agenda over the past year. Early in the pandemic, the G20's emphasis was on using the flexibility already allowed for in existing regulatory standards to support the financial system, and on assessing vulnerabilities (such as the solvency of non-financial corporations) arising from the pandemic and related restrictions on economic activities. More recently, there has been a shift towards supporting the economic recovery, including by ensuring the flow of finance to the real economy. Accordingly, the G20 cautioned that measures supporting the recovery should not be withdrawn prematurely. The G20 continues to take stock of the lessons learned during the pandemic, including identifying areas where further progress could be made to improve the resilience of the financial system.

Due to the economic recovery, the Financial Stability Board (FSB) and other global bodies have been able to resume work that had been suspended as part of the international re-prioritisation of work in light of the COVID-19 pandemic. In particular, joint work between the FSB and global standard-setting bodies has resumed on a range of issues including non-bank financial intermediation (NBFI), climate-related work and cross-border payments. As discussed below, the Reserve Bank is involved in some of these workstreams. The Bank works with other domestic agencies with responsibilities for financial stability and regulation through the Council of Financial Regulators (CFR). The CFR also provides a forum for agencies to coordinate their work within international groups, according to their mandates.

Financial Stability Board (FSB)

Purpose

The FSB promotes international financial stability by coordinating national financial sector authorities and international standard-setting bodies as they work towards developing strong regulatory, supervisory and other financial sector policies. It also plays a central role in assessing new and evolving global trends and risks.

FSB members include representatives from 24 economies, as well as the main international financial institutions – including the Bank for International Settlements (BIS) and the IMF – and standard-setting bodies such as the Basel Committee on Banking Supervision (BCBS).

Reserve Bank involvement

The decision-making body of the FSB is the Plenary. The Governor is a member of the Plenary, as well as the Steering Committee and the Standing Committee on Assessment of Vulnerabilities.

Senior Bank staff, mainly from Financial Stability and Payments Policy departments, participate in meetings of various FSB groups, including:

- the Analytical Group on Vulnerabilities, which supports the work of the Standing Committee on Assessment of Vulnerabilities

- the Financial Innovation Network

- the Official Sector Steering Group

- the Working Group on Regulatory Issues of Stablecoins.

A key role of the FSB is monitoring financial system trends and developments, to identify, assess and address new and emerging risks to global financial stability. The FSB also has an important coordination role, which was evident in its response to the COVID-19 pandemic via the sharing of information on policy responses and assessing their effectiveness. In April 2021, the FSB published a report setting out the relevant considerations, and trade-offs, when unwinding support measures. The report highlighted the benefits of a flexible ‘state-contingent’ approach when considering whether to extend, amend or end regulatory support measures, and to do so in a gradual and targeted way to minimise long-term financial stability risks. In July 2021, the FSB presented an interim report to the G20 on the initial lessons learnt from the pandemic for financial stability. It found that the global financial system has thus far weathered the pandemic thanks to greater resilience, supported by the G20 reforms following the Global Financial Crisis (GFC), and the swift and determined international policy response. Authorities broadly used the flexibility within agreed international standards to support financing to the real economy.

Assessing vulnerabilities arising from the pandemic is part of the broader vulnerabilities work conducted by the FSB, which is a core part of its mandate. During the year, a working group under the FSB's Standing Committee on Assessment of Vulnerabilities resumed its development of a comprehensive surveillance framework for assessing global financial system vulnerabilities. The Bank's Assistant Governor (Financial System) chaired one of the group's workstreams, which developed a survey allowing respondents to detail their top domestic, global and emerging vulnerabilities. This survey forms part of the new surveillance framework.

Another key focus of the FSB's vulnerabilities work over the year has been the NBFI sector, and developing reforms to enhance its resilience. Given the turmoil experienced by money market and other funds during the peak of the pandemic, the FSB's initial focus is on these areas. The Bank contributes to this work through its ongoing membership of the FSB's Non-bank Monitoring Experts Group, which conducts an annual global monitoring exercise to assess NBFI trends and analyse potential risks.

As health and economic outcomes improved throughout 2020/21, the FSB was able to progress further its non-pandemic-related work in several other areas, including previously agreed priorities on the G20 financial regulatory agenda. This work is being conducted through a number of groups, including some in which the Bank participates, such as:

- The Financial Innovation Network, which undertakes analysis of the financial stability implications of financial innovation, including through financial technology (‘FinTech’). Recent focus areas have included: the provision of financial services by ‘BigTech’ firms in emerging market and developing economies; the use of regulatory and supervisory technology (‘RegTech’ and ‘SupTech’) by financial institutions and regulators; and ongoing monitoring of crypto-asset developments.

- The Working Group on Regulatory Issues of Stablecoins, which has been examining evolving approaches to the regulation, supervision and oversight of global stablecoin arrangements.

- The Cross-border Crisis Management Group for Financial Market Infrastructures (a sub-group of the Resolution Steering Group), which has been working on resolution arrangements for central counterparties (CCPs). This has included issuing guidance in November 2020 on financial resources to support CCP resolution and the treatment of equity in resolution, and conducting the first resolvability assessment process for systemically important CCPs. The group also held a series of workshops for bank and CCP supervisory and resolution authorities to discuss the potential financial stability impact from the use of recovery and resolution tools, led jointly with the BCBS, the Committee on Payments and Market Infrastructures (CPMI) and the International Organization of Securities Commissions (IOSCO).

- The Official Sector Steering Group, which is progressing reforms of interest rate benchmarks, including coordinating the transition away from the London Inter-Bank Offered Rates (LIBOR) towards alternative interest rate benchmarks by the end of 2021, when most LIBOR tenors will cease. A key focus of this group is to ensure financial markets and institutions are well prepared for a smooth transition away from LIBOR by the end of 2021, with no new use of LIBOR in contracts beyond this date.

- The working group evaluating the ‘-big-to-fail’ (TBTF) reforms. As part of a program of assessing the effectiveness of post-global financial crisis (GFC) reforms, this group examined the extent to which the TBTF reforms have reduced the systemic and moral hazard risks associated with global and domestic systemically important banks, as well as their broader effects on the financial system. In its final report released in March 2021, it found that the TBTF reforms have made banks more resilient and amenable to resolution, and that reforms have produced net benefits for society.

- The working group looking at US-dollar funding and emerging market economy (EME) vulnerabilities. This group is examining the interaction of US-dollar funding pressures and fund outflows in EMEs, as input into enhanced risk monitoring and discussions on policies to address systemic risks in NBFI. The FSB will update the G20 in October on work in this area as part of a progress report on its overall NBFI work program.

The FSB is also progressing international policy work to enhance cross-border payments that had been a priority of Saudi Arabia (which held the 2020 G20 Presidency). In October 2020, the G20 endorsed a ‘Roadmap’ developed by the FSB, in coordination with the CPMI and other international bodies, to make cross-border payments cheaper, faster, more transparent and more inclusive. The Roadmap sets out an ambitious five-year program of goals, milestones and responsibilities to address various inter-related frictions in wholesale and retail cross-border payment arrangements. The first major action on the Roadmap was the May 2021 release of a consultation on the FSB's proposed global targets for cost, speed, transparency and access. The targets are intended to act as a foundation for the subsequent work within the Roadmap. The G20 has asked the FSB to monitor progress on the Roadmap work and report annually (with the first progress report due in October 2021). Bank staff were involved in the development of the Roadmap, and are participating in a number of international working groups that deal with aspects of the Roadmap work, including an FSB working group assessing the issue of ‘know-your-customer’ (KYC) and identity information sharing (see below under ‘CPMI’).

The FSB is also engaged in other work priorities, including cyber security and addressing the effects of climate change on the financial sector. As noted above, the FSB has ongoing work to evaluate the effectiveness of the G20's financial sector reforms following the GFC, as well as monitoring the implementation of those and other financial sector regulatory changes. More generally, and as its response to the GFC and the pandemic demonstrated, the FSB would again play a central coordinating role for the G20 in the face of any emerging risks and issues affecting the global financial system in the period ahead.

Bank for International Settlements (BIS)

Purpose

The BIS and its associated committees play an important role in supporting collaboration among central banks and other financial regulatory bodies. They do so by bringing together officials to exchange information and views about the global economy, vulnerabilities in the global financial system and other issues affecting the operations of central banks.

Reserve Bank involvement

The Reserve Bank is one of 63 central banks and monetary authorities holding shares in the BIS. The Governor or Deputy Governor participates in the bimonthly meetings of governors and in meetings of the Asian Consultative Council. The Governor chairs the Committee on the Global Financial System (CGFS), and the Assistant Governor (Financial Markets) is a member of the Markets Committee and the CGFS.

The CGFS seeks to identify potential sources of stress in the global financial system and promotes the development of well-functioning and stable financial markets. The Markets Committee considers how economic and other developments, including regulatory reform and technological change, may affect financial markets, particularly central bank operations.

These committees have been monitoring the challenges for financial systems and markets from the COVID-19 pandemic, and provide an important means for central banks to share perspectives on the evolving economic recovery and their policy responses. Areas of focus have included: monitoring global financial vulnerabilities, including the risks around so-called ‘cliff edges’ that could arise when support programs come to an end; market functioning during the crisis, including in international US dollar funding markets, and associated policy responses; the risks posed by volatile capital flows, especially in light of the more protracted health and economic recovery in many EMEs; the development of markets for bail-in-able debt; and ESG considerations in central bank operations.

These committees also carried out work on a number of longer-term topics through the year, many of which took on additional relevance in light of the pandemic. During 2020/21, Reserve Bank staff participated in a number of committee sub-groups, including:

- a CGFS working group on debt and financial stability, examining drivers of aggregate debt and its main trends, the relationship between household and corporate debt and financial stability, and how policymakers can manage risks to financial stability

- a Markets Committee working group on market functioning, looking at the tools available to central banks to respond to market dysfunction in core local currency markets, the efficacy of those tools in different scenarios and market structures, and their potential benefits and costs

- a Markets Committee study group looking at the rising use of foreign exchange execution algorithms and market functioning, with the final report published in October 2020

- an Asian Consultative Council study group on Asia-Pacific foreign exchange markets looking at ways to strengthen market monitoring, develop deep and efficient foreign exchange markets, and encourage widespread use of foreign exchange hedging.

The BIS Innovation Hub launched the BIS Innovation Network in January 2021, and established working groups to support the Innovation Hub's priorities. The Reserve Bank chairs the working group exploring the application of emerging supervisory and regulatory technologies to common challenges facing member central banks.

Basel Committee on Banking Supervision (BCBS)

Purpose

The BCBS is hosted by the BIS and is the primary international standard-setting body for the banking sector. It provides a forum for regular cooperation on banking supervisory matters among its 28 member jurisdictions. It seeks to enhance understanding of key supervisory issues and improve the quality of banking supervision worldwide.

Reserve Bank involvement

The Governor is a member of the Group of Governors and Heads of Supervision (GHOS), which is the oversight body for the BCBS. The Assistant Governor (Financial System) is a member of the BCBS.

As the main global standard-setter for the banking sector, the COVID-19 pandemic's risks to the banking system and related vulnerabilities were again key focus areas of the BCBS over the past year. Given early concerns that a severe pandemic and extreme containment measures could affect bank resilience, the BCBS responded quickly to help coordinate prudent and measured adjustments to banking standards in order to support banks through the crisis (such as deferrals in the implementation schedule for key BCBS reforms). More broadly, post-GFC reforms had enhanced bank resiliency over the past decade, with banks having ample capital and liquidity heading into the pandemic. Further, the BCBS reiterated that banks could make use of capital and liquidity buffers if needed so as to absorb financial shocks and to support the real economy by continued lending.

While health and economic outcomes have improved, the BCBS continues to monitor developments relating to the pandemic and its risks for the banking sector, especially given an uneven economic recovery and an uncertain global economic environment. In particular, the GHOS tasked the BCBS with continuing to pursue a coordinated approach on appropriate prudential responses to the crisis, so as to preserve a level playing field and avoid regulatory fragmentation. The Bank, along with the Australian Prudential Regulation Authority (APRA), was involved in these and broader discussions at BCBS meetings over the year.

In addition to focusing on the pandemic, the BCBS resumed or initiated work in other areas during 2020/21. This included releasing two sets of principles that strengthen the operational resilience of banks. This was particularly timely given the pandemic tested banks' operational resilience via increased remote working arrangements and their reliance on technology and third-party suppliers. As with other bodies, the BCBS continues to evaluate its post-GFC reforms, to assess their effectiveness and determine if there are gaps or unintended consequences. A current evaluation is assessing the impact of Basel III standards during the pandemic. Over the year, the GHOS endorsed the BCBS's 2021–22 workplan, as well as the recommendations arising from a strategic review by the BCBS, to focus on new and emerging topics, including structural trends in the banking sector, digitalisation of finance and climate-related financial risk.

The Bank had been a member of the BCBS's Macroprudential Supervision Group (MPG) for several years. This group monitored system-wide risks arising from the banking sector and, among other areas, worked on the design and implementation of the global systemically important bank and counter-cyclical capital buffer regimes. However, following the BCBS's recent strategic review, several new working groups were established. The MPG's role was merged into one of the new bodies and the Reserve Bank is currently reviewing its membership across the new working groups.

Committee on Payments and Market Infrastructures (CPMI)

Purpose

The CPMI is hosted by the BIS. It serves as a forum for central banks to monitor and analyse developments in payment, clearing and settlement infrastructures, and sets standards for these sectors. The CPMI has 28 member institutions.

Joint working groups of the CPMI and IOSCO bring together members of these two bodies to coordinate policy work on the regulation and oversight of financial market infrastructures (FMIs).

Reserve Bank involvement

Staff members from Payments Policy Department are members of the CPMI, the CPMI-IOSCO Steering Group, the CPMI-IOSCO Implementation Monitoring Standing Group and the CPMI-IOSCO Policy Standing Group. The Head of Payments Policy Department was the Chair of the CPMI's RTGS (Real-time Gross Settlement) Working Group, which included a staff member from Payments Settlements Department as a participant.

Staff members from the Payments Policy and Payments Settlements departments are participating in a number of CPMI workstreams contributing to the G20 Roadmap to enhance cross-border payments, including groups looking at improving cross-border payment providers' access to payment systems, harmonising cross-border payment message formats and data protocols, and exploring issues involved in possible new infrastructure for cross-border payments (such as global stablecoins and central bank digital currencies).

The CPMI published a number of reports during the year to which Payments Policy Department staff contributed, including a report in July 2021 on the issues associated with the possible use of central bank digital currencies for cross-border payments. Staff members also contributed to a CPMI-IOSCO implementation monitoring report.

Cooperative Oversight Arrangements

Purpose

The Reserve Bank participates in several multilateral and bilateral arrangements to support its oversight of foreign-headquartered FMIs that play an important role in the Australian financial system.

Reserve Bank involvement

Staff from Payments Policy Department participated in:

- an arrangement led by the Federal Reserve Bank of New York to oversee CLS Bank International, which provides a settlement service for foreign exchange transactions

- a global oversight college and a crisis management group for LCH Limited, both chaired by the Bank of England

- an information-sharing arrangement with the US Commodity Futures Trading Commission, in relation to CME Inc

- the Society for Worldwide Interbank Financial Telecommunication (SWIFT) Oversight Forum, chaired by the National Bank of Belgium (NBB)

- the Multilateral Oversight Group for Euroclear Bank, chaired by the NBB

- discussions hosted by the Swiss Financial Market Supervisory Authority on a payment system licence application by the Swiss-based Diem Association in respect of the proposed Diem (formerly Libra) stablecoin payment system (the application has since been withdrawn following a strategic shift in the Diem project to the United States).

International Monetary Fund (IMF)

Purpose

The IMF oversees the stability of the international monetary system via:

- bilateral and multilateral surveillance, which involves monitoring, analysing and providing advice on the economic and financial policies of its 190 members and the linkages between them; Article IV consultations, which are a key means to do this, are conducted for Australia every year

- the provision of financial assistance to member countries experiencing actual or potential balance of payments problems.

Reserve Bank involvement

Australia holds a 1.38 per cent quota share in the IMF and is part of the Asia and the Pacific Constituency, which is represented by one of the IMF's 24 Executive Directors. Australia also contributes to the IMF's supplementary borrowed resources, including the Poverty Reduction and Growth Trust (PRGT). The Reserve Bank supports the Constituency Office at the IMF by seconding an advisor with expertise in economic and financial sector matters; the Bank also works with the Australian Treasury to provide support to the Constituency Office on matters discussed by the IMF's Executive Board.

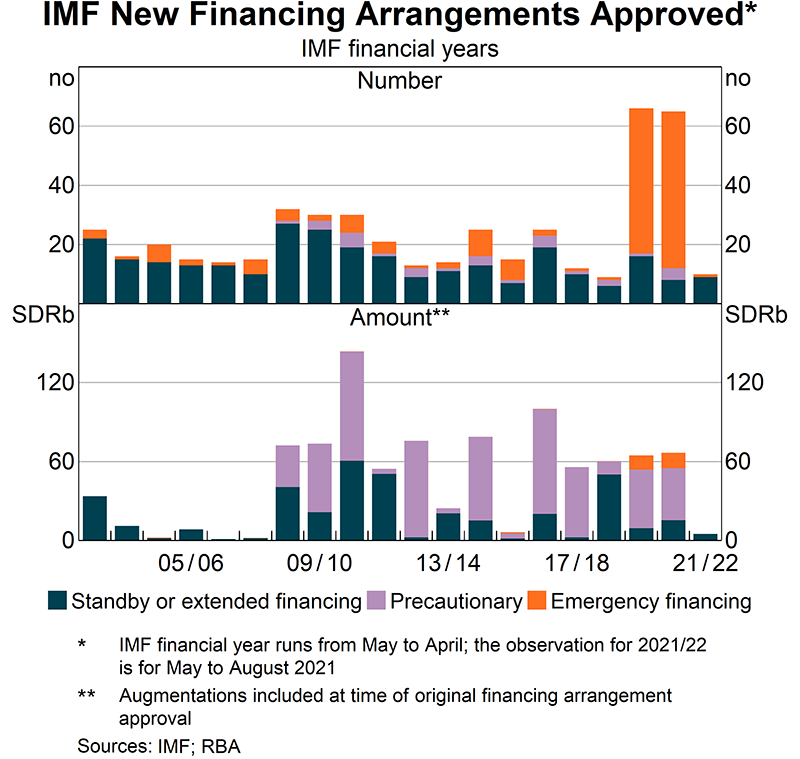

The IMF has continued to provide financial assistance to member countries to support their COVID-19 pandemic response. IMF lending at the beginning of the pandemic was largely in the form of emergency financing arrangements that were quickly disbursed and do not have conditionality attached once the funds have been lent. Since then, IMF lending has transitioned to longer-term, reform-based programs and precautionary facilities that can be called upon when needed. In the 12 months to June 2021, 11 new non-emergency facilities were approved, with a total value of SDR12.8 billion. IMF total credit outstanding increased by around 12 per cent over 2020/21. The Australian Government also made a commitment to lend SDR500 million to the IMF's PRGT, which provides concessional financial support to eligible countries. This loan has begun to be drawn down.

In August 2021, the IMF made a general SDR allocation worth around US$650 billion to support the global recovery from the crisis by addressing the long-term global need for reserve assets. A general allocation of SDRs is distributed across IMF member countries in proportion to their quota share in the IMF. Australia received SDR6.3 billion (US$8.9 billion at the date of the general allocation). Member countries can exchange their SDRs for ‘hard currency’ such as US dollars. This ‘hard currency’ can then be used for reasons such as meeting balance of payments needs or financing health-related expenditures. The Bank helps to facilitate this via Australia's voluntary trading arrangement with the IMF (see chapter on ‘Operations in Financial Markets’). The IMF has also been exploring a number of options for members with strong external positions to channel SDRs to help support the financing needs of developing or emerging economies.

The Fund periodically undertakes Financial Sector Assessment Program (FSAP) reviews of its members' financial systems and regulatory frameworks. The Fund last undertook an FSAP review of Australia in 2018. The Reserve Bank and other CFR agencies have continued to implement recommendations arising from this review. The recommendations of direct relevance to the Bank relate to the regulation of FMIs, including recommendations to implement a resolution regime for FMIs and to strengthen supervisory and enforcement powers for clearing and settlement facilities. As joint regulators for clearing and settlement facilities, the Bank and the Australian Securities and Investments Commission worked together to provide policy proposals to the Australian Government in July 2020. The Government announced in May 2021 that it would introduce reforms to strengthen FMI supervision and provide crisis management powers over domestic clearing and settlement facilities.

Executives' Meeting of East Asia-Pacific Central Banks (EMEAP)

Purpose

EMEAP brings together central banks from 11 economies in the east Asia-Pacific region – Australia, China, Hong Kong SAR, Indonesia, Japan, South Korea, Malaysia, New Zealand, the Philippines, Singapore and Thailand – to discuss issues relevant to monetary policy, financial markets, financial stability and payments systems in the region.

Reserve Bank involvement

The Reserve Bank participates in EMEAP, including at the Governor and Deputy Governor levels. In July and August 2021, the Bank chaired the EMEAP Governors' meeting and the EMEAP Governors' and Heads of Supervision meeting. In addition, the Deputy Governor is the Chair of the EMEAP Monetary and Financial Stability Committee. Staff also participate in the EMEAP Working Groups on Financial Markets, Banking Supervision, and Payments and Market Infrastructures, and in meetings of Information Technology Directors. These groups maintain close relationships with international institutions, such as the IMF and the BIS, through regular dialogue on topical issues.

The EMEAP Monetary and Financial Stability Committee has provided an important forum to discuss economic and financial market developments arising from the COVID-19 pandemic, and the associated policy challenges for EMEAP members. The Committee also shared views on potential emerging risks, including those relating to the banking sector, asset prices and capital flows. In addition, several sessions were held on topics of strategic importance to the members, including central bank use of big data, cross-border payments and sustainable finance. The Committee met via videoconference four times in 2020/21.

The Working Group on Financial Markets focuses on the analysis and development of foreign exchange, money and bond markets in the region. Every second meeting of this group is held in conjunction with the BIS Financial Markets Forum. During the year, the group continued its work on developing local currency bond markets, through the Asian Bond Fund Initiative (see chapter on ‘Operations in Financial Markets’ for details of the Bank's investments in the Asian Bond Fund). Areas of focus in 2020/21 also included the green bond market in Asia, financial benchmark reform and bond market functioning following the onset of COVID-19.

The Working Group on Banking Supervision (which also includes representatives of EMEAP members' prudential regulators, including APRA) meets to discuss banking supervision issues that are of interest in the region. It also discusses wider regional financial sector issues and conducts joint work on relevant topics. A key topic in its meetings over 2020/21 has been the sharing of information on financial system and regulatory developments in light of the pandemic, including discussing the factors that would drive an unwinding of policies introduced as a result of COVID-19. There were several other topics discussed over the year, including workstreams on sustainable finance and climate stress testing, emergency liquidity assistance, banks' liquidity, lending to small and medium-sized enterprises, and macroprudential analysis.

The EMEAP Working Group on Payments and Market Infrastructures is a forum for sharing information and experiences relating to the development, oversight and regulation of retail payment systems and FMIs. During 2020/21, discussions in the group focused on a number of issues, including: the impact of COVID-19 on the operation of payment systems and FMIs; initiatives to enhance the speed, cost and transparency of cross-border payments; evolving views and research on central bank digital currencies; the modernisation of real-time gross settlement systems; and approaches to the oversight of FMIs. During the past year, the group also completed a review of developments in cross-border retail payments in EMEAP jurisdictions, which highlighted some of the innovations as well as ongoing challenges in the provision of such services.

The Information Technology Directors' Meeting provides a forum for discussions on developments in information technology and its implications for central banks. Topics discussed during 2020/21 included the COVID-19 technology response and remote working approaches, cybersecurity and digital operating models.

Network for Greening the Financial System (NGFS)

Purpose

The NGFS is a group of central banks and supervisors whose purpose is to share best practices, contribute to the development of climate and environment-related risk management in the financial sector, and mobilise mainstream finance to support the transition towards a sustainable economy. As at the end of June 2021, the Network had grown to 95 central banks and supervisors around the world.

Reserve Bank involvement

The Reserve Bank joined the NGFS in July 2018. The Deputy Governor represents the Bank on the NGFS Plenary, supported by other senior staff. Over 2020/21, the Bank actively participated in a number of workstreams, which have published reports throughout the year. The RBA has also joined an NGFS taskforce to undertake work on climate-related legal risks facing central banks and supervisors.

The NGFS released an updated set of reference scenarios to support the work of central banks and supervisors in assessing the magnitude and direction of climate-related risks in their own jurisdictions. These scenarios are being used as the starting point for APRA's climate vulnerability exercise that seeks to gain a better understanding of the climate risks of Australia's five largest banks. The NGFS has also produced a series of reports in 2020/21, including: an overview of how financial institutions analyse environmental risks and the barriers to wider adoption of this type of analysis by the financial services industry; a progress report on the implementation of sustainable and responsible investment practices in central banks' portfolio investments; a survey on monetary policy operations and climate change, setting out key lessons for further analysis; a review of options for adapting central bank operations to support climate mitigation efforts; a report on sustainable finance market developments; and a progress report on bridging data gaps.

Global Foreign Exchange Committee (GFXC)

Purpose

The GFXC is a forum that brings together central banks and private sector participants in the wholesale foreign exchange market. The GFXC aims to promote a robust and liquid market. One means by which it does this is through the maintenance of the FX Global Code as a set of principles of good practice for market participants.

Reserve Bank involvement

The Deputy Governor has served as Chair of the GFXC since June 2019. The Reserve Bank sponsors the Australian Foreign Exchange Committee (AFXC), one of the 20 regional committees that comprise the membership of the GFXC. The Assistant Governor (Financial Markets) is Chair of the AFXC and the Bank's representative on the GFXC.

During the past year, the GFXC concluded its review of the FX Global Code, revising around one-fifth of the Code's principles of good practice. Changes were made to strengthen the Code's guidance on disclosures, algorithmic trading and transaction cost analysis, anonymous trading, and settlement risk. To facilitate greater transparency around market practices, the GFXC also developed and published templates for disclosures and for the provision of information on execution algorithms and transaction cost data. Additionally, the GFXC published guidance papers on the practices of ‘pre-hedging’ and ‘last look’.

Organisation for Economic Co-operation and Development (OECD)

Purpose

The OECD comprises the governments of 38 countries and provides a forum in which governments can work together to share experiences and seek solutions to common problems, including economic and financial ones.

Reserve Bank involvement

On behalf of the Australian Treasury, the Reserve Bank's Chief Representative in Europe participates in the OECD's Committee on Financial Markets and the Advisory Task Force on the OECD Codes of Liberalisation.

The OECD Committee on Financial Markets examines a range of financial market issues and aims to promote efficient, open, stable and sound financial systems. Focus areas for the committee in 2020/21 were COVID-19 finance support programs, ESG investment, climate transition risks and real estate financing. The Committee had regular discussions with private sector experts during the year on these topics. The Committee also continued to review and contribute to the OECD's work on blockchain, asset tokenisation, digitalisation and financial literacy.

The OECD's Codes of Liberalisation promote the freedom of cross-border capital movements and financial services. All OECD members adhere to the Codes. The Advisory Task Force meets periodically to address questions and discuss policy issues related to the Codes, and examines specific measures by individual adherents with relevance to their obligations under the Codes.

Technical cooperation and bilateral relations

Australia Indonesia Partnership for Economic Development (Prospera)

The Bank participates in the Australian Government's ‘Prospera’ program, which is aimed at institutional capacity-building in Indonesia. Under the Prospera Program, the Reserve Bank engages with Bank Indonesia on a broad range of activities undertaken by central banks. In 2020/21, Reserve Bank staff met virtually with Bank Indonesia staff to provide support for the development of a fast payments system, and discuss issues relating to the digitalisation and automation of cash management.

Engagement in the South Pacific

The Reserve Bank fosters close ties with South Pacific countries through participation in high-level meetings, staff exchanges and the provision of technical assistance across a wide range of central banking issues.

In November 2020, the Reserve Bank attended the annual meeting of the South Pacific Central Bank Governors via videoconference. The Governors discussed recent economic and financial developments and work under way to jointly develop a regional KYC facility to support the provision of remittances services to the South Pacific. With the Reserve Bank of New Zealand, the Bank is co-chairing the steering committee for the KYC project. Work on this project has been progressing steadily, and the central bank working group is planning to present a business case to Governors in late 2021.

The Bank also provides financial support for an officer of the Bank of Papua New Guinea to undertake postgraduate studies in economics, finance or computing at an Australian university. This support is provided via the Reserve Bank of Australia Graduate Scholarship, which was first awarded in 1992. The most recent scholar completed studies at the University of Queensland in July 2020 and has since returned to Papua New Guinea. The continuing COVID-19 pandemic has delayed selection of the next scholar and no studies are being undertaken at present. When circumstances permit, selection of the next scholar will take place and the scholarship arrangements will resume.

International visitors and secondments

The continuing COVID-19 pandemic and the ongoing closure of Australia's borders meant that the Bank has received no international visitors since March 2020. In 2020/21, the Bank hosted secondees from the Bank of England and the Reserve Bank of New Zealand. Reserve Bank staff were seconded to other central banks and international organisations, including the Bank of England and the IMF. These arrangements facilitate a valuable exchange of skills and expertise between the Bank and the broader global economic and financial policymaking community.

Endnote

The Framework Working Group helps to implement the G20's ‘Framework for Strong, Sustainable and Balanced Growth’. [1]