What is Monetary Policy?

Download the complete Explainer 387KB

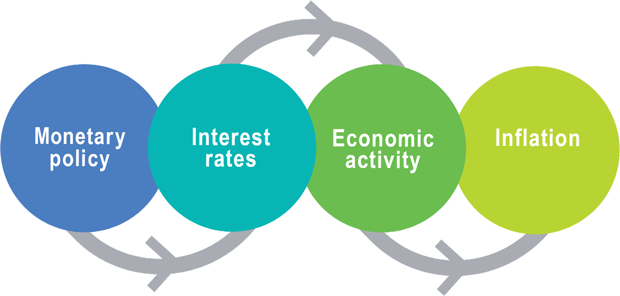

In Australia, monetary policy involves influencing interest rates to affect aggregate demand, employment and inflation in the economy.[1] It is one of the main economic policies used to stabilise business cycles. The Reserve Bank is responsible for monetary policy in Australia, and it sets a target for the nation's official interest rate, which is referred to as the ‘cash rate target’. The cash rate target is the conventional tool of monetary policy in Australia. Monetary policy has, at times, also included other tools, such as forward guidance, the provision of term funding to the banking system, a yield target, and quantity targets for the purchase of government bonds.

Monetary policy has a strong influence over interest rates in the economy, including the lending and deposit rates faced by households and businesses. In turn, these interest rates influence economic activity, employment and inflation. This Explainer focuses on two key topics related to monetary policy in Australia.

- What are the objectives of monetary policy?

- How are monetary policy decisions made and implemented?

What are the objectives of monetary policy?

The Reserve Bank Board has three objectives when setting monetary policy. The three objectives are:

- The stability of the currency of Australia

- The maintenance of full employment in Australia

- The economic prosperity and welfare of the people of Australia.

These are set out in the Reserve Bank Act 1959. They are also included in the Statement on the Conduct of Monetary Policy in which the Reserve Bank and the government have agreed on the framework for monetary policy and how the Reserve Bank can best meet its responsibilities.

Since the early 1990s, the Reserve Bank has used an inflation target to achieve its monetary policy objectives. Maintaining low and stable inflation is important for achieving sustainable growth in economic activity and employment.

Box: The Objectives of Monetary Policy

Stability of the currency

This objective is interpreted to mean low and stable inflation. Inflation is an increase in the general level of prices of the goods and services that households buy (see Explainer: Inflation and its Measurement). Low and stable inflation preserves the value, or purchasing power, of money over time.

Full employment

This objective relates to the Reserve Bank promoting an environment that supports full employment. Full employment occurs when there are enough jobs for people who are available and want to work. Even at full employment, some people might be unemployed because of skill mismatches or as they move between jobs (see Explainer: Unemployment: Its Measurement and Types).

Economic prosperity and welfare

This objective relates to the Reserve Bank promoting an environment that supports the economic prosperity and welfare of the Australian people. This is primarily achieved by maintaining a stable macroeconomic environment, but it also means the Reserve Bank Board considers other factors, such as financial stability, when setting monetary policy.

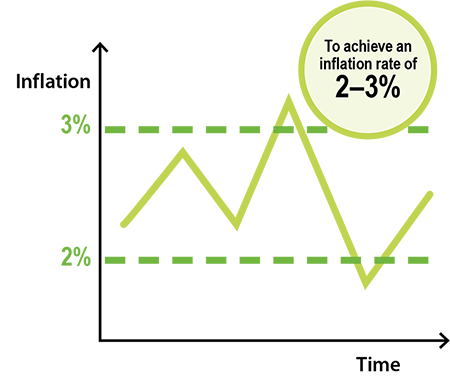

Australia's flexible inflation target

The Reserve Bank uses an inflation targeting framework to guide its monetary policy decisions. Australia has a flexible inflation target, which is to keep consumer price inflation between 2 and 3 per cent. The Reserve Bank Board sets monetary policy such that inflation is expected to return to the midpoint of the target (see the Statement on the Conduct of Monetary Policy).

This approach to inflation targeting provides the Reserve Bank Board with flexibility to set monetary policy to achieve its objectives. The inflation target provides a clear benchmark so that the Reserve Bank can be held accountable for its management of the economy (see Explainer: Australia's Inflation Target).

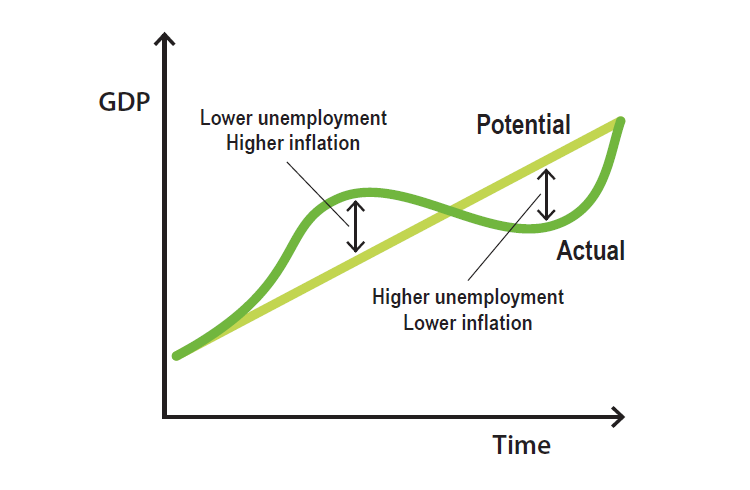

Smoothing the business cycle

Economic growth tends to fluctuate around a long-term trend. When the economy grows too slowly because of weak demand, the Reserve Bank can loosen monetary policy, such as by lowering the cash rate target to stimulate economic growth and employment. On the other hand, when the economy grows too quickly because of excessively strong demand, the Reserve Bank can tighten monetary policy, such as by raising the cash rate target to dampen economic activity and contain inflation.

It is important to remember that monetary policy is a tool used to smooth fluctuations in the business cycle. While it can help support long-term economic growth by avoiding costly recessions or financial crises, it cannot create long-term economic growth by permanently stimulating demand. Any attempt to do so results in higher inflation. Long-term economic growth is ultimately determined by the availability and productivity of an economy's resources such as labour, land and capital.

Management of trade-offs

The Reserve Bank Board must balance its objectives of both price stability and full employment. The flexible inflation target allows the Reserve Bank to address short-run trade-offs that may occur between economic growth, employment and inflation.

For example, there could be occasions when inflation might be too high at the same time that economic growth is too low and unemployment is too high. In these cases, the Reserve Bank must carefully consider the trade-off between smoothing the business cycle (in particular economic growth and unemployment) in the short run and achieving its inflation target.

If inflation is too high, tightening monetary policy (which raises interest rates in the economy) will help to bring inflation back towards the target, but will also be likely to reduce economic growth and put upward pressure on unemployment, all else being equal. A trade-off between objectives could also occur if an easing (or tightening) of monetary policy was judged to adversely affect the Reserve Bank's broader responsibilities, such as financial stability.

Financial stability

The Reserve Bank is also responsible for financial stability and considers it when making monetary policy decisions. A stable financial system is resilient and helps money flow even when the economy slows or there are disruptive events. Financial stability is critical to achieving a stable economic environment. The Global Financial Crisis demonstrated how damaging a lack of financial stability can be (see Explainer: The Global Financial Crisis).

One way the Reserve Bank promotes financial stability is through monetary policy. Having a framework for low and stable inflation and sustainable economic growth promotes an environment that will generally be conducive to financial stability. But if things do go wrong, the Reserve Bank has an important role in crisis management.

The Reserve Bank has the power to lend money to solvent banks in exchange for other assets if they need it. This is an important role for most central banks and is why they are sometimes referred to as being the ‘lender of last resort’. The Reserve Bank also monitors risks to the financial system and publishes its analysis in its half-yearly Financial Stability Review (see In a Nutshell: Financial Stability).

Relationship with the government

The Reserve Bank Board sets monetary policy independently of the government. This principle of central bank independence is generally accepted internationally and helps prevent manipulation of monetary policy for political purposes. It also allows monetary policy to be focused on achieving objectives over the longer term.

The Reserve Bank Board (including the Governor and Deputy Governor) is appointed by the government and is expected, along with the Reserve Bank's employees, to serve the people of Australia to the best of their ability.

Transparency and accountability

Making sure that the Reserve Bank's views on economic developments and policy decisions are transparent is crucial to shaping inflation expectations and maintaining the public's trust.

The Reserve Bank's decisions about monetary policy are explained publicly through several channels to ensure accountability. These include announcing and explaining the monetary policy decision on the second day of the meeting along with a media conference, releasing the minutes of the meeting two weeks later, and publishing analysis and commentary on financial markets and the economic outlook in the Statement on Monetary Policy four times a year.

The Governor also appears twice yearly before the House of Representatives Standing Committee on Economics to answer questions about the Reserve Bank's conduct of policy.

How are monetary policy decisions made and implemented?

The Board process

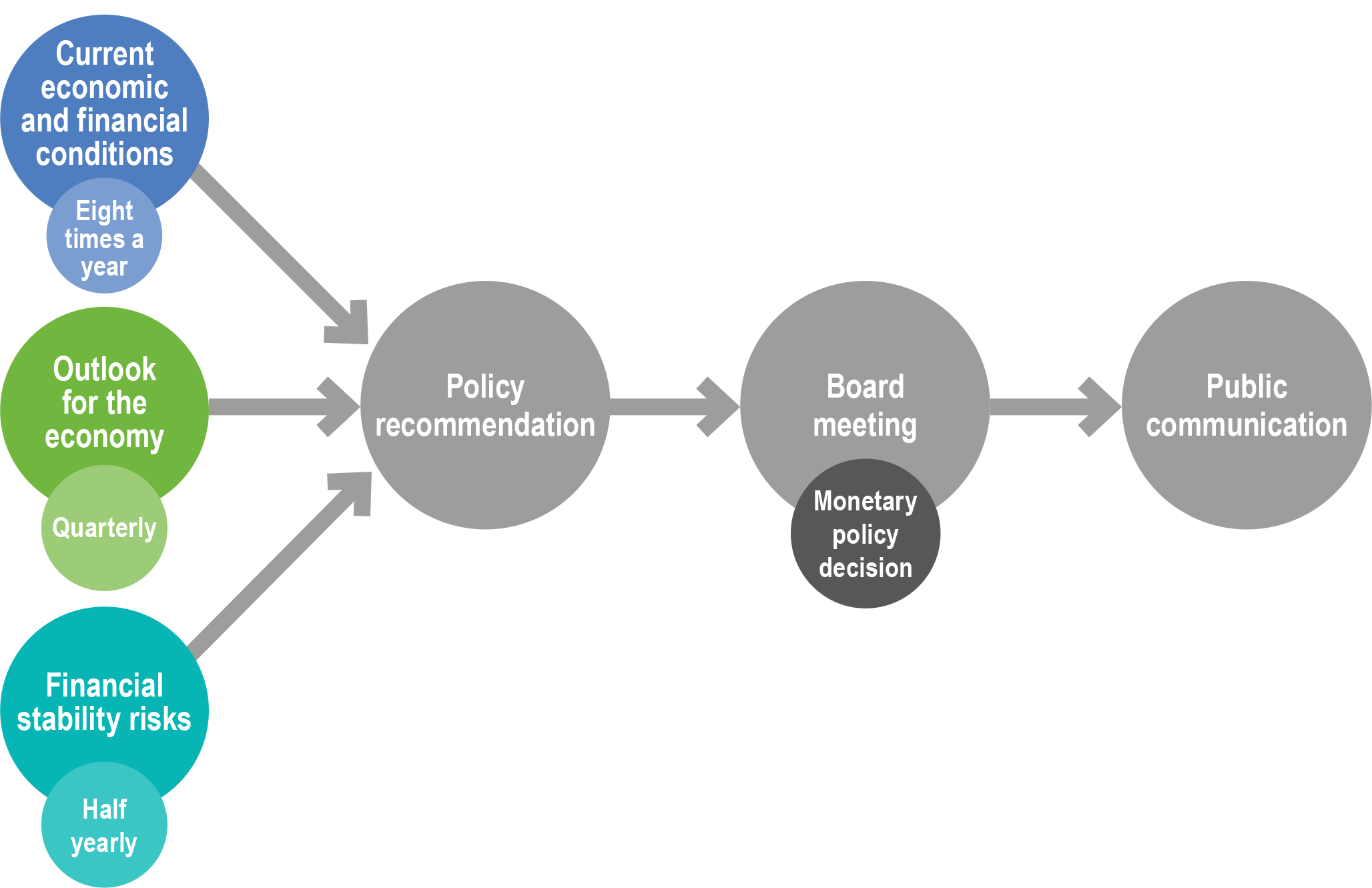

The Reserve Bank Board makes the decisions about Australia's monetary policy. The Board has nine members, of which at least five (including the Governor as Chair or Deputy Governor as Deputy Chair) must be present to conduct a meeting. The Board meets eight times a year. The meetings start on the Monday afternoon and then continue on the Tuesday morning.

The Board discusses a broad range of issues that help it assess whether or not the stance of monetary policy is consistent with its objectives. Prior to each Board meeting, Reserve Bank staff prepare detailed papers on developments in the Australian and international economies and financial markets. These papers include a recommendation for the monetary policy decision.

The monetary policy decision is made by a majority vote (with the Chair having an additional casting vote if required). The Board's decision is announced to the public at 2.30 pm on the second day of the meeting. The Governor holds a media conference after each Board meeting to explain the decision. Minutes of the Board meeting are published two weeks later, providing transparency to the public about the factors that influenced the decision.

The implementation process

After the Board has announced what the stance of monetary policy should be, the Reserve Bank ensures that its transactions in domestic money markets are consistent with its targets. Through its interaction with commercial banks in domestic money markets, the Reserve Bank maintains the ‘cash rate target’, which is the interest rate on overnight loans between banks, at a level consistent with the cash rate target. The Reserve Bank has, at times, also sought to influence longer term interest rates with other tools. It has done this in a number of ways, including by using forward guidance, setting a yield target, quantity targets for the purchase of government bonds, and providing low cost long term funding directly to banks (see Explainer: How the Reserve Bank Implements Monetary Policy).

The transmission of monetary policy

Monetary policy influences interest rates in the economy – like interest rates for housing loans, business loans and interest rates on savings accounts. Changes in interest rates influence people's decisions to invest or consume, which ultimately affects economic growth, employment and inflation. This occurs through a number of channels (see Explainer: The Transmission of Monetary Policy). As a result, monetary policy helps to smooth the business cycle in a manner that is consistent with the inflation target.

Footnotes

Conventional monetary policy typically involves the use of interest rates or, in some economies, exchange rates. Unconventional monetary policy includes tools such as ‘quantitative easing’ (see Explainer: The Global Financial Crisis). [1]