How the Reserve Bank Implements Monetary Policy

Download the complete Explainer 101KBThe Reserve Bank of Australia implements monetary policy using a variety of tools. The primary tool of monetary policy is the cash rate target, while other tools have, at times, included forward guidance, price and quantity targets for government bond purchases, and the provision of low-cost long-term funding to financial institutions. This Explainer describes how each tool is implemented.

1. Cash Rate Target

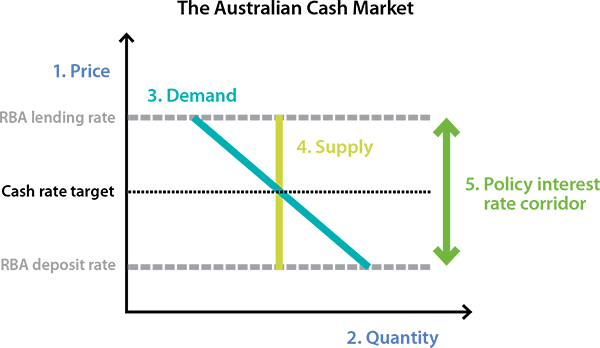

How the cash rate target is implemented can be explained by stepping through five aspects of the cash market: the price, quantity, demand, supply and the policy interest rate corridor.

1.1 Price

The cash market is where banks lend and borrow funds from each other overnight. The price in this market is the interest rate on these loans. In Australia, this interest rate is called the cash rate. As the Reserve Bank sets a target for the cash rate, it is often referred to as a ‘tool’ of monetary policy. Prior to the COVID-19 recession, the cash rate target was the Reserve Bank's only active monetary policy tool.

1.2 Quantity

The quantity traded in this market is called Exchange Settlement (ES) balances, which are used to settle interbank transactions. Banks have deposit accounts at the Reserve Bank to record the value of their ES balances. Because the Reserve Bank is Australia's central bank and controls banknotes available to the public, ES balances are considered to be the equivalent of cash.

1.3 Demand

Banks use ES balances as a store of value and to make payments between each other. Some of these payments are on behalf of their customers and some are related to their own business. Demand may vary for a number of reasons, including changing financial market conditions.

1.4 Supply

Prior to the COVID-19 recession, the Reserve Bank managed the supply of ES balances so that it met estimated demand and the cash rate was as close as possible to its target. This was mainly achieved with open market operations to manage factors that can change the supply of ES balances.

In particular, the Reserve Bank typically managed the supply of ES balances through repurchase agreements (repos). A repo is a transaction with two parts. In the first part, the Reserve Bank could lend ES balances to a bank and receive a bond in exchange (see Explainer: Bonds and the Yield Curve). This increases the supply of ES balances available to banks. In the pre-arranged second part, the transaction is reversed. The Reserve Bank returns the bond and receives back the ES balances. As a result, the supply of ES balances decreases. This could help to manage changes in the supply of ES balances arising from other factors. For example, any payments made by the Australian Government or received into its accounts at the Reserve Bank will affect the supply of ES balances.

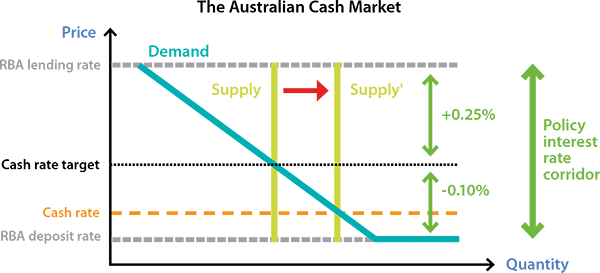

The package of policy measures introduced by the Board in response to the COVID-19 recession led to a substantial increase in ES balances. As a result, the Reserve Bank no longer conducts daily open market operations to manage ES balances. The cash rate is maintained consistent with the target through the interest rate corridor.

1.5 Policy interest rate corridor

The Reserve Bank currently pays an interest rate on ES balances that is 0.1 percentage points below the cash rate target. Banks have an incentive to deposit as little as possible at this rate, and instead prefer to earn the higher cash rate by lending out their balances.

The Reserve Bank is also willing to lend ES balances to banks if this is required. The interest rate on these loans is 0.25 percentage points above the cash rate target. Banks have an incentive to borrow as little as possible at this rate, and instead prefer to borrow at the lower cash rate in the market.

The deposit and lending rates form the lower and upper bounds of the policy interest rate corridor. Banks have no incentive to borrow or lend ES balances outside this corridor. If interest rates in the market were lower than the deposit rate paid by the Reserve Bank, banks would choose to hold more ES balances. Similarly, if market interest rates for cash balances were above the top of the corridor, banks would choose to borrow more cheaply from the Reserve Bank. The corridor represents a range within which banks have an incentive to trade ES balances among themselves.

The corridor also provides a mechanism for implementing changes to the cash rate target. The bounds of the corridor are set with reference to the target, so the corridor shifts in line with changes in the cash rate target, as do the incentives for trading within that range.

In response to the COVID-19 recession, the Reserve Bank began actively using other ‘unconventional’ monetary policy tools, such as its ‘Term Funding Facility’ and bond purchase program, which increased the supply of ES balances (that is, they shifted the supply curve in the cash market to the right). This caused the cash rate to drift below target. While the Reserve Bank still operates a corridor system, the increase in supply means that the cash rate can trade near the floor of the corridor, rather than at the cash rate target.

2. Unconventional Monetary Policy Tools

Since the COVID-19 recession, the Reserve Bank has actively used a number of other monetary policy tools.

Forward guidance

Forward guidance refers to public commitments made by the RBA as to how it will conduct monetary policy in the future. The RBA's forward guidance takes the form of describing the economic conditions the Board would look to see before it would consider raising the cash rate target. The guidance is based on the state of the economy – that is, it is ‘state-based’. For example, in mid March 2020, the Board communicated that it would not increase the cash rate target until progress was made towards full employment and it was confident that inflation would be sustainably within the 2-3 per cent target band. Reflecting community interest in the Bank's views about how long it will be before the economy will reach these conditions, the Board also provided a possible timeframe for when these conditions might be met. Given its forecasts at the time, the Bank initially expected this would take at least three years.

Price and quantity targets for asset purchases

In 2020, the Reserve Bank introduced explicit price and quantity targets for its purchases of government bonds. These programs were designed to reduce longer-term interest rates, lower funding costs and boost liquidity in the economy during the COVID-19 recession. The Reserve Bank purchased government bonds to: support a target for the interest rate on three-year bonds (the yield target); lower the yield on bonds with a term of longer than three years below where they would otherwise be; and support the smooth functioning of the bond market.

The Reserve Bank purchased government bonds issued by the federal and state governments in exchange for ES balances. Importantly, the Reserve Bank purchased bonds from the private sector in the secondary market, and not from governments directly.

Term Funding Facility

Also in 2020, the Reserve Bank established a ‘Term Funding Facility’ (TFF) in order to lower funding costs across the economy. The TFF provided low-cost, fixed term funding to banks and other financial institutions such as credit unions and building societies. The TFF worked by offering banks access to three-year loans with the interest rate fixed at the cash rate target. Because this interest rate was lower than banks were usually able to access, banks' funding costs declined and banks were able to offer lower interest rates on loans to households and businesses. The TFF launched in April 2020 and remained open for new borrowing until June 2021. All loans made under the TFF will mature by June 2024.

To learn more about unconventional monetary policy, see the Explainer: Unconventional Monetary Policy.

3. Future System of Monetary Policy Implementation

In March 2024, the Reserve Bank Board endorsed a plan to move to a new system of implementing monetary policy. It will use a system called ‘ample reserves’. Further details will be provided in due course.[1]

Endnotes

For more information, see Assistant Governor Christopher Kent’s speech The Future System for Monetary Policy Implementation. [1]