Bulletin – December 2018 Finance Understanding Exchange Rates and Why They Are Important

- Download 500KB

Abstract

Exchange rates are important to Australia's economy because they affect trade and financial flows between Australia and other countries. They also affect how the Reserve Bank conducts monetary policy. This article outlines how exchange rates are measured, the different types of exchange rate regimes, the factors that influence the exchange rate and how changes in the exchange rate affect the economy.

What is an Exchange Rate?

An exchange rate is the price of one currency expressed in terms of another currency or group of currencies. For small open economies such as Australia's that actively engage in international trade, the exchange rate is an important economic variable. Movements in the exchange rate influence the decisions of individuals, businesses and the government. Collectively, this affects economic activity, inflation and the balance of payments.

There are different ways in which exchange rates are measured. Over the years, there have been also different operational arrangements for determining Australia's exchange rate. The Australian dollar is now freely traded and is the fifth most traded currency in foreign exchange markets.

Bilateral exchange rates

A bilateral exchange rate refers to the value of one currency relative to another. It is the most commonly referenced type of exchange rate. Most bilateral exchange rates are quoted against the US dollar (USD), as it is the most traded currency globally. Looking at the Australian dollar (AUD), the AUD/USD exchange rate gives you the amount of US dollars that you will receive for each Australian dollar that you convert (or sell). For example, an AUD/USD exchange rate of 0.75 means that you will get US75 cents for every 1 AUD.

An appreciation of the Australian dollar is an increase in its value compared with a foreign currency. This means that each Australian dollar buys you more foreign currency than before. Equivalently, if you are buying an item that is priced in foreign currency it will now cost you less in Australian dollars than before. If there is a depreciation of the Australian dollar, the opposite is true.

Cross rates

Bilateral exchange rates can be used to calculate ‘cross rates’. A cross rate is an exchange rate that is calculated by reference to a third currency. For example, if you want to calculate how many AUD you would receive for each euro (EUR) (EUR/AUD), then you can use the AUD/USD and EUR/USD rates (i.e. EUR/AUD = EUR/USD ÷ AUD/USD).

Trade-weighted index (TWI)

While bilateral exchange rates are the most frequently quoted exchange rates, a trade-weighted index (TWI) provides a broader measure of trends in the value of a currency. A TWI captures the price of a domestic currency in terms of a weighted average group (or ‘basket’) of foreign currencies. The weights are generally based on a nation's major trading partners and the share of trade that takes place (usually total trade shares, but import or export shares can also be used). Sometimes this is referred to as an ‘effective exchange rate’. The Reserve Bank publishes a TWI for the Australian dollar each day.[1]

Because the TWI captures movements in the Australian dollar against the currencies of major trading partners, it can be helpful for understanding more about Australia's overall trade competitiveness. This can be particularly useful when bilateral exchange rates are moving in different directions. The TWI generally fluctuates less than bilateral exchange rates because it is measured against a basket of currencies and large movements will often partly offset each other (Graph 1). For example, during the global financial crisis, the depreciation of the AUD/USD was much greater than the depreciation in the TWI, mainly because the Australian dollar depreciated by less against the currencies of most of Australia's Asian trading partners.

Real effective exchange rate

Real variables take account of the effects of price changes whereas nominal variables do not. The real effective exchange rate is a nominal effective exchange rate (such as the TWI described above) multiplied by the ratio of Australian prices to prices of our trading partners. Since trade competitiveness is ultimately determined by changes in the price of Australian goods and services relative to foreign goods and services, the real TWI can be a better measure of trade competitiveness than the nominal TWI. It is often used in analytical work, whereas the other types of exchange rates are more visible in our daily lives.

Exchange Rate Regimes

There are numerous exchange rate regimes under which a country may choose to operate. At one end, a currency can float freely and at the other end it is fixed to another currency using a hard peg. There are two broad categories in this range – floating and pegged – although finer distinctions can also be used within these categories. Over the past century, Australia has experienced several different exchange rate regimes (see Box A: ‘A Brief History of Australia's Exchange Rate Regimes’) but has had a floating exchange rate since 1983.

Floating

Under a floating exchange rate regime, the value of the currency is determined by the market forces of demand and supply for foreign exchange. This is a common type of regime among the world's major advanced economies because it can contribute to macroeconomic stability by cushioning economies from shocks and allowing monetary policy to be focused on targeting domestic economic conditions.

There are three main advantages of having a floating exchange rate:

- The floating exchange rate acts as an ‘automatic stabiliser’ to help the economy adjust to external economic events. For example, during Australia's recent mining boom, the appreciation of the Australian dollar helped reallocate labour and capital to the booming mining sector by raising costs and reducing demand for the output of other sectors that did not directly benefit from higher commodity prices. This helped to reduce labour shortages and inflationary pressures.

- Monetary policy is free to respond to changes in domestic economic conditions, such as inflation and unemployment, instead of interest rates having to be set at a similar level to the interest rates in the economy to which the exchange rate is pegged (as is the case under a pegged exchange rate). During the mining boom, Australia had higher interest rates and the Australian dollar appreciated against other major advanced economies because the economy was growing relatively quickly. Had Australia fixed its exchange rate to those of other advanced economies, lower interest rates would have been required to prevent the appreciation of the Australian dollar, and this would have resulted in even faster growth in output and credit and higher inflation than otherwise, amplifying the effects of the boom.

- Central banks need less foreign currency reserves because they do not need to intervene in the foreign exchange market to achieve a particular fixed exchange rate.

Pegged

Under a pegged regime (sometimes referred to as a ‘fixed regime’), the central bank ties the value of its currency to another nation's currency. The exchange rate is controlled by intervening in the foreign exchange market (buying and selling currency) to minimise fluctuations and to keep the currency close to its target (or within a narrow target band). Usually the central bank from the economy maintaining the peg will also be forced to set interest rates at a similar level to those in the economy to which it is pegged to prevent investors shifting a large amount of funds between economies (these are known as capital flows) and pushing the exchange rate away from the peg.

The main advantage of a pegged exchange rate is certainty about the value of the exchange rate, which makes it simpler to trade with and invest in other economies. This can help to avoid excessive short-term volatility associated with changes in market sentiment or speculation, which can happen under a floating exchange rate. The main disadvantage is that the exchange rate can no longer move freely to act as an automatic stabiliser and insulate the economy from large economic events. A pegged exchange rate can also encourage borrowing in foreign currency, but these debts can be difficult to repay if the exchange subsequently depreciates. The central bank is also said to ‘lose control’ of monetary policy because it may need to change monetary policy to achieve a particular exchange rate rather than being able to respond to domestic economic conditions.

Box A: A Brief History of Australia's Exchange Rate Regimes

Australia has had several exchange rate regimes. Prior to the early 1930s, Australia operated under the gold standard. The gold standard meant that currency was redeemable for gold at a fixed price. The gold standard was abandoned in the midst of the Great Depression.

In 1931, Australia pegged its currency to the British pound sterling (Graph A1). This reflected the role of sterling as the primary currency used in international transactions and Australia's close economic ties with Britain. From 1944, the peg to sterling continued as part of a global system of pegged exchange rates, known as the Bretton Woods system. When the Bretton Woods system broke down in the early 1970s, the major advanced economies floated their exchange rates.[2] Australia maintained a pegged exchange rate, partly because the Australian financial system was relatively underdeveloped, but replaced the peg to sterling with a peg to the USD because of Australia's increasingly strong trade links with the US (Ballantyne et al 2014).

The Australian dollar was made progressively more flexible from the mid 1970s. This evolution was largely inevitable because Australian financial markets were becoming more sophisticated and integrated with global financial markets. These developments made it increasingly difficult for the authorities to manage the large international capital flows associated with maintaining a fixed exchange rate and, consequently, the difficulty in controlling domestic monetary conditions (Debelle and Plumb 2006).

In 1974, the Australian dollar was pegged against the TWI and, in 1976, this peg was changed from a ‘hard’ peg to a ‘crawling’ peg. The crawling peg involved the Reserve Bank making regular adjustments to the level of the exchange rate informed by an assessment of economic conditions. The Australian dollar was eventually floated in 1983. The decision had important effects on the Australian economy and how the Reserve Bank implemented monetary policy. It allowed the Reserve Bank to set monetary policy based on domestic economic conditions, which also made it possible to target inflation.[3] Together these changes have contributed to more stable macroeconomic outcomes for the Australian economy (Graph A2). The Australian dollar is now the fifth most traded currency in the world and the AUD/USD is the fourth most traded currency pair, partly due to our exposure to Asia and commodity prices (Graph A3).[4]

Does the Reserve Bank Intervene in the Foreign Exchange Market?

The Reserve Bank's approach to foreign exchange market intervention has evolved over the past 30 years as the Australian foreign exchange market has matured. Despite having a floating exchange rate, the Bank can still intervene in the foreign exchange market if it becomes disorderly or dysfunctional.

Direct intervention

Direct intervention refers to the Reserve Bank directly buying or selling foreign currency in the market. This has become less frequent and more targeted over time (Graph 2).[5] In the period immediately following the float, the Reserve Bank intervened regularly to better understand how the foreign currency market operated under the new floating regime and to smooth daily volatility (Newman, Potter and Wright 2011). But since financial markets have matured, direct intervention typically occurs when there is evidence of significant market disorder. For example, the Bank intervened during the global financial crisis to restore market liquidity and limit excessive price volatility. The effect of the Bank's presence in foreign exchange markets can itself have a significant impact on the exchange rate as it can reveal information on future policy intentions.

Indirect intervention

Some economies, particularly those with pegged exchange rates, may try to influence the exchange rate through changes to interest rates. This is referred to as indirect intervention. For example, an increase in the cash rate raises interest rates in Australia relative to those in the rest of the world. This increases returns on Australian assets (relative to foreign assets), which can result in increased demand for Australian dollars as investors shift their funds into Australian assets. As a result, an increase in the cash rate should be associated with an appreciation of the exchange rate. The opposite is true of a reduction in the cash rate. However, because Australia has a floating exchange rate, the exchange rate is best viewed as part of the transmission mechanism of monetary policy rather than being a target or instrument of monetary policy.[6]

What Factors Affect the Value of the Australian Dollar?

The value of the Australian dollar is determined by the forces of demand and supply in the foreign exchange market. There is a range of factors that influence that demand for and supply of Australia's currency.

International trade in goods and services

The Australian dollar is bought and sold when goods and services are exported and imported. Demand for Australian dollars will increase if exports from Australia increase (because Australian dollars will be bought to pay for these goods and services). The supply of Australian dollars in the foreign exchange market will typically increase if Australians import more (because Australian dollars will be sold to pay for the imports in foreign currency).

Capital flows

The Australian dollar is bought and sold when capital flows between Australia and other countries. These transactions therefore influence the value of the currency. Inward investment (foreigners purchasing Australian assets) creates demand for Australian dollars and puts upward pressure on the currency's value, while outward investment (Australians purchasing foreign assets) increases the supply of Australian dollars in foreign exchange markets and places downward pressure on the currency's value.

Interest rate differentials can affect capital flows and influence the exchange rate in the medium term. A rise in Australian interest rates relative to those overseas increases the relative return on Australian assets and may attract foreign direct and portfolio investment. This can be expected to boost demand for Australian dollars and causes the exchange rate to appreciate.[7]

Terms of trade

An important influence on the Australian dollar has been movements in our terms of trade - the ratio of export prices to import prices (Graph 3).[8] An increase in the terms of trade generally means that relatively more Australian dollars will be needed to purchase Australian exports or less foreign currency will be needed to purchase foreign imports. It is usually also associated with an increase in demand for Australian exports and may also be associated with an increase in foreign investment, which reinforces this effect. This is likely to result in higher aggregate demand and inflation, which puts upward pressure on domestic interest rates and the exchange rate. As a result, changes in Australia's terms of trade and exchange rate have tended to be positively related.

Purchasing power parity and relative inflation rates

The theory of purchasing power parity suggests that, in the long run, the exchange rate is affected by relative rates of inflation between countries. If a country's inflation rate is higher than its trading partners, its exchange rate will tend to depreciate in the long term to prevent higher prices from causing a loss of competitiveness. Graph 4 shows that higher inflation in Australia in the 1970 and 1980s, as measured by the rise in the ratio of the Australian consumer price index (CPI) to the average price level of Australia's trading partners, partly explains the depreciation in the Australian dollar as measured by the nominal TWI over the same period. Consequently, estimates of the real TWI, which adjust for this difference in inflation rates, can be helpful for understanding more about trade competitiveness.

Speculation

Exchange rate movements are also influenced by speculation, news and events. If speculators believe that the Australian dollar will depreciate in the future, they may sell Australian dollars and buy foreign currencies to make an expected profit. This would increase the supply of Australian dollars and cause its value to fall. Speculation can result in substantial short-term volatility in the exchange rate.

How Do Movements in the Exchange Rate Affect the Economy?

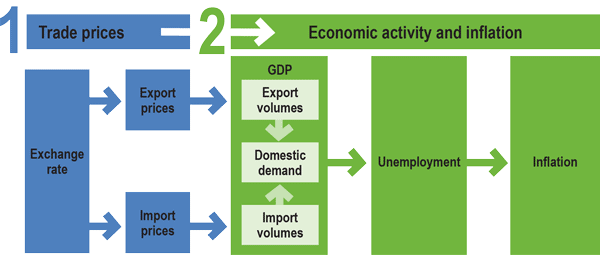

The exchange rate is an important mechanism for helping the Australian economy adjust to large economic events. This section focusses on the pass-through from a depreciation of the Australian dollar to the economy. The opposite outcomes are likely to occur for an appreciation in the exchange rate. The pass-through can be categorised into direct and indirect channels (Figure 1).

Direct effects

Movements in the exchange rate have a direct effect on the prices of goods and services produced in Australia relative to those produced overseas. When the Australian dollar depreciates, Australian-produced goods and services become cheaper compared to goods and services produced overseas. An appreciation of the Australian dollar will have the opposite effect. This direct effect on prices is sometimes referred to as ‘exchange rate pass-through’; it occurs very quickly for goods and services at the point of exit from or entry to the country, though there is a lag before it is evident in the final prices that consumers have to pay.

Indirect effects

Economic activity and the labour market

A depreciation of the Australian dollar reduces the relative price of Australian-produced goods and services in international markets, increasing their competitiveness. Because Australian goods and services become cheaper, compared to overseas goods and services, foreign demand for Australian goods and services should increase, leading to an increase in the volume (or quantity) of Australian exports and higher ultimately aggregate demand and employment in Australia.

At the same time, an exchange rate depreciation results in imported goods and services becoming relatively more expensive for Australian residents. In response, Australian residents are likely to reduce their consumption of more expensive imported goods and services and shift towards buying goods and services produced in Australia. This should lead to a decrease in the volume of imports, which also helps to support aggregate demand and employment.

Changes in export and import prices arising from a change in the exchange rate mainly influence demand for goods and services that are exported and imported (these are known as tradable goods and services). But exchange rate movements also have implications for the demand for non-tradable goods and services. In the case of a depreciation, the resulting increase in export volumes and decrease in import volumes will increase national income in Australia. This increase in national income will, in turn, increase demand for non-tradable goods and services produced in Australia. In order to meet the increased demand for their products, Australian firms might hire more workers, which will increase employment and should lower the unemployment rate.

Inflation and interest rates

In principle, a depreciation of the exchange rate will increase inflation in two ways. First, the prices of imported goods and services will increase, directly contributing to higher inflation. Second, the expansion of aggregate demand and increase in employment will cause an increase in wages and other costs. These costs are inputs to production and may be passed on to prices more generally. This should also contribute to higher inflation.

In practice, there is typically a lag between an exchange rate movement and its effect on economic activity and inflation. This is because firms may be reluctant to change their prices because exchange rates fluctuate and can move quickly. Households and firms also take time to adjust their spending patterns. The extent and timing of the responses will depend on how easy it is for households and firms to substitute between goods and services produced in Australia and goods and services produced overseas. Most estimates suggest that it takes between one and three years for exchange rate movements to have their maximum effect on economic activity and inflation.

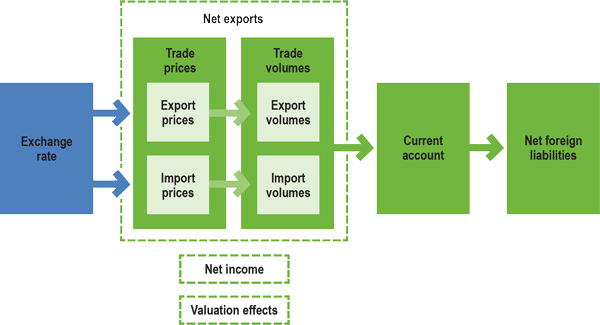

Balance of payments

When considering the implications of exchange rate movements for economic activity, changes in the volume of exports and imports matter. In determining the consequences of exchange rate movements for the balance of payments, however, it is the value – that is, the prices as well as the volumes – of exports and imports that matters. Once again, we use the example of a depreciation of the Australian dollar to describe these effects.

The direct effect of an exchange rate depreciation is to increase the price of imports relative to exports, which will tend to decrease the value of net exports (exports less imports) and widen the current account deficit (Figure 2). But the indirect effects of an exchange rate depreciation increase the volume of exports and reduce the volume of imports. This will have an offsetting effect and tend to increase net exports and reduce the current account deficit.

These two effects differ in their timing. The direct effect of an exchange rate depreciation occurs immediately, while the indirect effects on export and import volumes typically occur with a lag. Because of this, in the short term, an exchange rate depreciation is likely to reduce the value of net exports. But over time, as export and import volumes start to respond, an exchange rate depreciation is likely to increase the value of net exports. This pattern is sometimes referred to as the ‘J curve’.

Exchange rate movements also affect the other major component of the current account – the net income deficit. An exchange rate depreciation will increase the cost to Australian residents of servicing foreign debt that is denominated in foreign currency. This is because the amount of Australian dollars required to purchase the foreign currency needed to pay the interest owed on the debt has increased. This increases net income outflow and widens the current account deficit. On the other hand, an exchange rate depreciation will increase the income that Australian residents receive on their foreign asset holdings, as the returns on those assets are now larger in terms of Australian dollars. This reduces net income outflow and narrows the current account deficit. (Although Australia's foreign liabilities exceed its foreign assets, a large proportion of the foreign liabilities are denominated in Australian dollars so that a depreciation of the Australian dollar will actually tend to reduce Australia's net income deficit. This is because the interest owed and dividends paid on the foreign liabilities are not affected by the change in the exchange rate but the returns on the foreign assets are.)

An exchange rate depreciation has an additional effect on the balance of payments through valuation effects on Australia's net foreign liabilities. Valuation effects occur because a depreciation of the Australian dollar increases the value in Australian dollars of assets and liabilities denominated in foreign currency. As was the case for the net income deficit, because the foreign assets of Australian residents that are denominated in foreign currency exceed the liabilities of Australian residents denominated in foreign currency, an exchange rate depreciation will tend to reduce the value of Australia's net foreign liabilities.

Conclusion

Australia's floating exchange rate has an important influence on trade and financial flows between Australia and the rest of the world and consequently on Australia's economy. It also has an important influence on how monetary policy influences the economy and how the Reserve Bank achieves its monetary policy objectives.

Footnotes

The author wrote this work while with the Public Access & Education Team. The article builds on Explainers that have been published on ‘Exchange Rates and their Measurement’ and ‘Exchange Rates and the Australian Economy’. The author would like to acknowledge colleagues who contributed to these Explainers, particularly Jason Griffin, Susan Black and Sam Nightingale. [*]

Australia's TWI is published daily. The weights used to calculate the TWI are published annually. Details about the method for calculating TWI are also available. [1]

The Bretton Woods system was designed to create a stable climate for international trade. It was named after the town in New Hampshire where the agreement was signed. The system eventually broke down in 1971 when the decision was made to sever the convertibility of the US dollar to gold. This decision was made because the US did not have enough gold to cover the amount of US dollars outstanding at the convertible price, which meant the US dollar was overvalued. [2]

For further discussion about the decision to float the Australian dollar and its impact since then, see Stevens (2013). [3]

Investors can effectively gain exposure to developments in the Asia region and commodity prices by investing in the Australian dollar, since the Australian dollar is seen to fluctuate closely with developments in the Asia region because of our close trade ties. [4]

The Reserve Bank's approach to foreign exchange market intervention is discussed further in Newman, Potter and Wright (2011). [5]

The transmission of monetary policy is discussed further in Atkin and La Cava (2017). [6]

For further discussion of the impact of interest rates on the exchange rate see Kearns and Manners (2005); Blundell-Wignall, Fahrer and Heath (1993); and Gruen and Wilkinson (1991). [7]

For more information on the terms of trade see Atkin et al (2014) and Heath (2015). [8]

References

Atkin T and G La Cava (2017), ‘The Transmission of Monetary Policy: How Does It Work?’, RBA Bulletin, September, pp 1–8.

Atkin T, M Caputo, T Robinson and H Wang (2014), ‘Australia after the Terms of Trade Boom’, RBA Bulletin, March, pp 55–62.

Ballantyne A, J Hambur, I Roberts and M Wright (2014), ‘Financial Reform in Australia and China’, RBA Research Discussion Paper No 2014-10.

Blundell-Wignall A, J Fahrer and A Heath (1993), ‘Major Influences on the Australian Dollar Exchange Rate’, in Proceedings of a Conference, Reserve Bank of Australia, Sydney.

Debelle G and M Plumb (2006), ‘The Evolution of Exchange Rate Policy and Capital Controls in Australia’, Asian Economic Papers, 5(2), pp 7–29.

Gruen D and J Wilkinson (1991), ‘Australia's Real Exchange Rate – Is it Explained by the Terms of Trade or by Real Interest Differentials?’, RBA Research Discussion Paper No 9108.

Heath A (2015), ‘The Terms of Trade: Outlook and Implications’, Resources and Energy Workshop hosted by the Department of Industry, Innovation and Science, Canberra, 20 November.

Kearns J and P Manners (2005), ‘The Impact of Monetary Policy on the Exchange Rate: A Study Using Intraday data’, RBA Research Discussion Paper No 2005-02.

Kulish M and D Rees (2015), ‘Unprecedented Changes in the Terms of Trade’, RBA Research Discussion Paper No 2015-11.

Newman V, C Potter and M Wright (2011), ‘Foreign Exchange Market Intervention’, RBA Bulletin, December, pp 67–76.

RBA (2005), ‘Commodity Prices and the Terms of Trade’, RBA Bulletin, April.

Stevens G (2013), ‘The Australian Dollar: Thirty Years of Floating’, Speech to the Australian Business Economists' Annual Dinner, Sydney, 21 November.