What is Money?

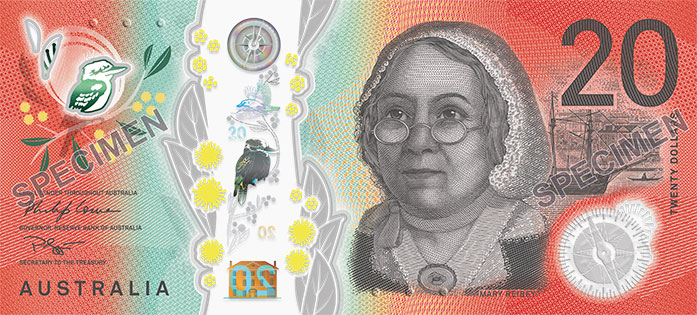

Download the complete Explainer 3.8MBThroughout history and around the world, money has taken diverse forms – from cowrie shells, copper ingots, rum and gold coins in the past, through to colourful pieces of paper or polymer and digital bank records today (see images 1, 2, 3 and 4). Throughout Australia's own history, a variety of different tokens of exchange have been used as money (see Box: Early Forms of Money in Australia). What links these different forms of money is not their physical qualities but the function they perform: each in their era were trusted as a reliable way to pay or be paid, as a way to quote prices and as a way to store value over time. In other words, they were a:

- widely accepted means of payment

- unit of account

- store of value.

These three attributes are in fact the standard definition of what makes something ‘money’.

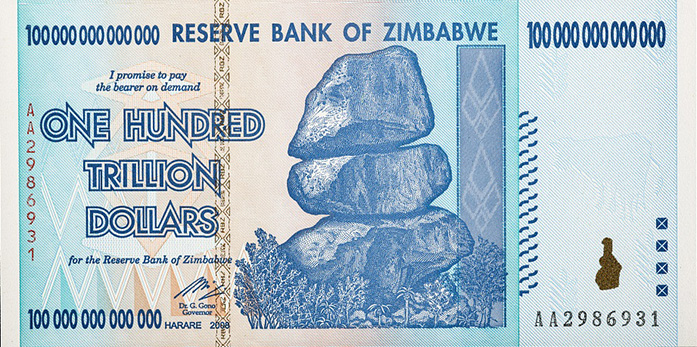

The material or item used as money does not need to have any value in its own right. Some forms of money have had this feature (e.g. gold coins, copper ingots), while others have not (e.g. paper banknotes). Rather, money derives its value from the trust people place in it. History shows, however, that this trust can be lost if mismanaged. For example, if too much paper money is printed and issued, the value of the money will fall; that is, high inflation will result. In fact, hyperinflation can result. This has happened many times through history, including in Zimbabwe in the late 2000s, resulting in the population abandoning the Zimbabwe dollar (see image 5) and switching to other, more stable currencies such as the US dollar.

Maintaining a stable currency and avoiding high inflation is in fact one of the core functions of central banks. Indeed, the Reserve Bank Act 1959, which established the Reserve Bank, explicitly singled out ‘price stability’ as one of the Reserve Bank’s monetary policy objectives (the other being full employment).

Image: Hyde Park Barracks Museum collection, Sydney Living Museums, HPB/UG269.

Museums Victoria, NU 22518.

Image: British Museum, 2014, 2011.38.

Issued by the Reserve Bank of Zimbabwe

Box: Early Forms of Money in Australia

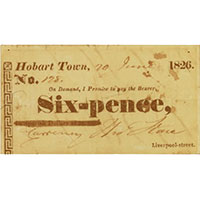

When the colony of New South Wales was established in 1788, colonists relied on barter and rum (spirits) as a makeshift currency. In 1792, a shipment of Spanish dollars was sent to Australia for use as currency alongside the other international currencies that were used in the colony at the time. To address persistent coin shortages, new forms of money were developed in the following decades. These included the creation of the holey dollar and dump by Governor Macquarie (see images 6 and 7) (which made two coins out of one), the use of promissory notes (see image 8) or IOUs, and copper tokens (see image 9) issued by businesses. IOUs and copper tokens proved an unreliable source of currency, partly because they had no official guarantee.

In 1825, the British Government legislated a sterling currency for the colony, which remained the basis of Australian currency until the transition to decimal currency, the Australian dollar, in 1966. Australia's first gold coins were minted in 1855. The gold rushes spurred the development of banking and commercial banks issued banknotes backed by gold, though these banknotes did not constitute a national currency. Like many other countries at the time, Australia adhered to the gold standard and the total amount of notes that banks could issue was limited by their gold reserves. Under the gold standard, money was ‘backed’ by gold – countries agreed to convert paper money into a fixed amount of gold. At the turn of the twentieth century, Australia's currency remained a mixture of British coins, Australian coins and the notes of private banks and the Queensland Government.

In 1910, legislation for a national currency was enacted. The Australian Government issued ‘superscribed’ banknotes, whereby words were overprinted on notes purchased from the private banks (see image 10). These were the first currency notes accepted across the nation. The first true Australian banknote was produced in May 1913, with additional denominations produced from 1913 to 1915.

Image: State Library of New South Wales, FL390234.

Image: State Library of New South Wales, FL398749.

Image: Note Printing Australia Limited.

Image: Reserve Bank of Australia archives, NP-004014.

Learn more about how banknotes are produced in the Bulletin article on Money in the Australian Economy.

Why do we need money?

Money has value because people trust that it has value today and will continue having value in the future. But history shows that this trust is sometimes broken, so why do people keep on using money? The answer is that it is incredibly useful for facilitating trade, which in turn has led to higher living standards.

Trade allows people to specialise in producing those things in which they have a comparative advantage. Even the most capable person would struggle if they had to find food, build shelter and make clothes entirely on their own. If that individual lived within a community, however, and could trade with others, then each community member could specialise in one area – maybe fishing, building houses or making clothes – and become very skilled in that task. By trading with each other, each member of the community would benefit from the specialist skills developed by the other community members.

So what is the role of money? It enables production and trade on a large scale. If you live in a small village where you know and trust everyone, you may be willing to give up some of your fish catch today to others in the knowledge that when you need (for example) clothes, the tailor will give you something to wear. If you live in a larger town, where you may not know or trust people so well, you probably won't give away your fish to anyone who asks, as you might not trust, for example, that a tailor will give you new clothes if you ask later on. While you could try to solve this problem of lack of trust with barter, barter usually doesn't work very well. For example, the tailor might not want your fish when you need new clothes – indeed, the tailor might not ever want fish, nor have the specific clothes you need. With money, however, you can sell your fish to whoever wants fish, save some of the money they pay you and take it to the tailor when you need clothes (or to whomever you want to purchase something from and whenever you need to).

In brief, money makes trade with people we might not know or trust possible, and trade makes a society prosperous. Trust is now placed in the value of money, rather than in every person we might want to buy from or sell to.

What forms of money are used in a modern economy?

There are two main forms of money that exist in modern economies:

- coins and banknotes (i.e. currency)

- deposits held in accounts at banks or other authorised deposit-taking institutions.

Currency is a physical form of money, while deposits held in accounts with a financial institution are a digital form of money and comprise the greatest share of money in a modern economy. (Learn more in the Bulletin article on Money in the Australian Economy.) There is also a subtle difference between currency and deposit account balances. Currency is backed by the central bank, which eliminates any risk of default. Deposit account balances, on the other hand, are liabilities of privately owned financial institutions (because the depositor can ask for them back) and these institutions are at possible risk from default. Nonetheless, while this risk has materialised in some countries, in Australia it is extremely low. (Australia's banks are well capitalised and regulated, depositors are paid out first if a bank gets into trouble, and there is a Financial Claims Scheme in which the government provides a limited guarantee for household deposits of individuals below $250,000.)

What is legal tender?

Legal tender is a form of payment recognised by the legal system such that, when it is offered (‘tendered’) in payment of a debt, the debt is legally discharged (i.e. the creditor cannot refuse a legal tender and then later pursue the debtor in court for the debt). Banknotes are legal tender under the Reserve Bank Act 1959 and coins are legal tender under the Currency Act 1965. The system of money, where the currency of a country is not backed by a physical commodity (e.g. gold) but by a directive from a government that makes it legal, is called a ‘Fiat’ system.

How is money created?

Australia's banknotes are produced by the Reserve Bank of Australia, while coins are produced by the Royal Australian Mint. Banknotes account for most of the value of physical money and we focus on them in this Explainer. Under established agreements, commercial banks purchase banknotes from the Reserve Bank as required to meet demand from their customers. Hence, growth in the value of banknotes in circulation represents growth in the demand for cash from the general public.

From the perspective of money ‘creation’, deposits can also be created when financial intermediaries make loans.[1] While the process of extending loans is central to the process of money creation, this does not mean that financial intermediaries are able to make loans and create money without limits. Deposit-taking institutions need to meet certain regulatory requirements and must be satisfied that borrowers can pay back their debts.

Deposits can also be created by the Reserve Bank, such as when the Reserve Bank purchases government bonds (for more information, see Explainer: How the Reserve Bank Implements Monetary Policy). When the Reserve Bank purchases government bonds from the non-bank private sector, households and businesses ultimately deposit the proceeds of the sale into the banking system, adding to total deposits.

Is Bitcoin money?

Bitcoin, and other ‘cryptocurrencies’, fulfil some of the attributes of money, but not all of them. Most notably, they can be used as a medium of exchange – some businesses and individuals will accept bitcoin as payment, though the number of businesses willing to accept bitcoin is low (i.e. it is not a widely accepted means of payment). On the other two attributes of money – being a unit of account and a store of value – bitcoin fails. Shops do not quote prices in bitcoins; rather, shops that accept bitcoin typically quote prices in the local currency and then do a conversion to bitcoin at the current exchange rate if someone wants to pay that way. They do this in part because the price of bitcoin is very volatile, with this volatility being one reason why bitcoin is a poor store of value. (For more information see Explainer: Digital Currencies.)

Why don't all countries use the same money?

While a single, stable form of money used by every country in the world would help people spend and save with confidence and plan for the future, it would make it harder for individual economies to respond to economic shocks. By having their own unit of account (i.e. their own currency), countries have more flexibility in economic management. They can choose to allow the value of their currency to fluctuate freely in response to economic events and to conduct their own economic policies (in particular monetary policy) independently of those in other countries. Consequently, individual countries (or groups of countries with similar economic features, e.g. the member countries of the euro area) usually have their own currency.

What is the future of money?

Money has changed form many times over the years, but for as long as complex societies have existed, there has been money. The only confident prediction that can be made about money is that as long as people want to trade with each other, money will continue to exist in some form because the functions it performs are central to sustaining economic activity.

Footnotes

While payments by governments increase the deposits in accounts of households or businesses at banks or other deposit-taking institutions, they do not create money because they must be funded by an offsetting transaction that reduces deposits. A government transfer that increases the deposits held by households must be funded by issuing bonds or taxation, both of which reduce deposits. [1]