September 2019

- Download the complete Bulletin 4.3MB

The Committed Liquidity Facility

The Reserve Bank provides the Committed Liquidity Facility (CLF) as part of global reforms to improve the resilience of the banking system. The CLF is required due to the low level of government debt in Australia. This limits the amount of high-quality liquid assets that financial institutions can reasonably hold as a buffer against periods of stress. Under the CLF, the Reserve Bank commits to providing a set amount of liquidity to institutions, subject to them satisfying several conditions. These include having paid a fee on the committed amount. No financial institution has needed to draw upon the CLF in response to a period of financial stress.

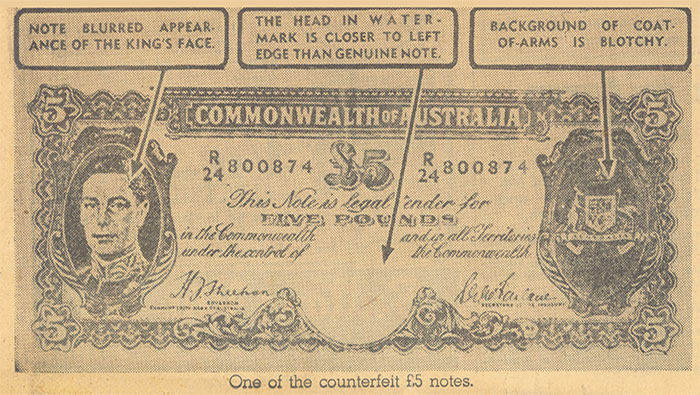

A Brief History of Currency Counterfeiting

The crime of counterfeiting is as old as money itself, and can be targeted at both low- and high-value denominations. In most cases, counterfeiting is motivated by personal gain but, at times, it has also been used as a political weapon to destabilise rival countries. This article gives a brief history of counterfeiting, with a particular focus on Australia, highlighting selected incidents through time and the policy responses to them. For source material on Australia, we draw on Reserve Bank archives dating back to the early 1900s.

Education Choices and Labour Supply During the Mining Boom

The mining boom led to large increases in wages for many lower-skilled jobs in mining regions. This raised the opportunity cost of remaining in school, TAFE or university for many students, particularly those in mining areas. I show that this led fewer people in those areas to pursue tertiary study. These educational responses were an important source of labour market adjustment during the boom. It accommodated most of the strong rise in the labour force participation rate of 15–24 year olds in the resource-rich states, and 5–10 per cent of the total additional labour supply needed in those states.

The Changing Global Market for Australian Coal

Coal is one of Australia’s largest exports, and has accounted for around one-quarter of Australia’s resource exports by value over the past decade. However, demand in the global market for coal has been evolving in recent years, which is creating some uncertainties for the longer-term outlook for coal exports. Looking forward, demand will be shaped by the speed of the transition towards renewable energy sources, changing steel production technologies, and the pace of global economic growth. Over the next few years, Australian coal production and exports are expected to grow fairly modestly.

Liberalisation of China's Portfolio Flows and the Renminbi

China’s equity and bond markets have grown rapidly to be among the largest in the world, yet, until recently, participation by foreign investors has been limited. Over recent decades, the Chinese authorities have relaxed investment restrictions to allow greater foreign access to these capital markets. This has enabled greater foreign investment and for global equity and bond index providers to increase the weight of Chinese securities in their indices, which are tracked by a range of global investment funds. These developments have contributed to an increase in gross foreign capital flows into China and they are likely to continue to support inflows in the period ahead. At the same time, an increase in Chinese resident portfolio outflows is also likely as domestic investors seek to diversify by investing abroad. The opening of China’s financial markets entails benefits associated with deeper global financial integration, but may also contribute to greater variability in the renminbi.

Bank Balance Sheet Constraints and Money Market Divergence

The spread between key Australian money market interest rates has widened and become more volatile in recent years. While this might seem to imply scope to profit from arbitrage – by borrowing at a low rate to invest at a higher one – banks have additional balance sheet considerations that need to be taken into account. We find that money market trades have generally not been profitable for the four major banks since the financial crisis. This is partly because debt funding costs have fallen by less than money market returns. In addition, equity funding, which is more expensive than debt, has increased. Consequently, the incentive for banks to arbitrage between money market interest rates has fallen. We also note that banks tend to prefer more profitable lines of business, such as lending for residential housing, over the narrow margins implied by money market arbitrage.

Survival Analysis and the Life of Australian Banknotes

The Reserve Bank is in the process of replacing Australia’s first full series of polymer banknotes – the ‘New Note Series’ – with the upgraded ‘Next Generation Banknote’ series. This presents a good opportunity to review our experience with polymer banknotes, and in particular, examine how they have worn in practice. To do so, I extend an existing survival modelling approach to estimate how long a given polymer banknote from the ‘New Note Series’ might be expected to last when in use by the general public. I find that $5 and $10 banknotes have tended to last for around 5 years on average, while $20 and $50 banknotes have lasted for 10 and 15 years on average, respectively. I have not modelled $100 banknotes as they are overwhelmingly used for store-of-value purposes and so do not tend to wear out.

The graphs in the Bulletin were generated using Mathematica.

ISSN 1837-7211 (Online)