March 2021

- Download the complete Bulletin 5.95MB

Cash Demand during COVID-19

Since the onset of the COVID-19 pandemic, the value of banknotes in circulation has risen sharply. This was despite cash being used much less for everyday transactions. Much of the strong demand for banknotes can be attributed to people's desire to hold cash for precautionary or store-of-wealth purposes. This behaviour is common during periods of significant economic uncertainty and stress, and many other countries saw similar patterns of cash demand.

Property Settlement in RITS

Property transactions are among the largest and most significant financial undertakings that many Australians enter into. As with other aspects of Australia's economy, innovation and technological change have led to the introduction of electronic solutions for property conveyancing, replacing the traditional paper-based process. To support the shift to electronic conveyancing, in 2014 the Reserve Bank of Australia introduced new functionality in the Reserve Bank Information and Transfer System to enable near real-time settlement of interbank obligations relating to property transactions. This functionality minimises settlement risk for the transfer of property ownership, while also ensuring that the property settlement process remains secure, reliable and efficient.

From the Archives: The London Letters

The Reserve Bank has a rich and unique archives that captures almost 2 centuries of primary source material about Australia's economic, financial and social history. To enhance public access to these records, we have launched a digital platform, Unreserved. Unreserved enables users to browse information about our archival collection and directly access our digitised records. Unreserved will be regularly populated with new records as the digitisation of the Bank's archives progresses. The first release of records is a ‘sampler’ of the diversity of information in our archives. This article introduces Unreserved and highlights a particular series – the London Letters – which comprises the information exchanged between the Bank's head office and its London Office from 1912 to 1975. The London Letters provide insights into the development of Australia's central bank, along with its role and experiences during some of the most significant events of the 20th century.

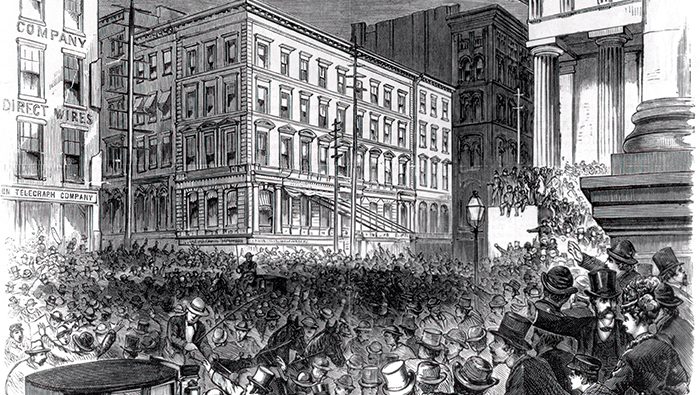

The Anatomy of a Banking Crisis: Household Depositors in the Australian Depressions

Looking into archival material can provide a new lens through which to view historical events. With the launch of Unreserved, the RBA has released archival records to the public, including longitudinal data on individual bank depositors that uncovers new facts about the behaviour of Australian households during the economic depressions of the 1890s and 1930s. Depositors responded to both depressions by withdrawing more money, consistent with households drawing down on their saving buffers in the face of rising unemployment and falling incomes. The net withdrawal rate of depositors also increased when deposit interest rates fell and when public confidence in the banking system deteriorated, with clear evidence of a run on a savings bank in the 1930s. In more normal times, most saving deposits were ‘sticky’ with transactions being very rare. This high degree of deposit stickiness appears to be because most people held these bank accounts to save for significant life events. While it is difficult to draw policy implications from the historical analysis, some features of the depositor behaviour are likely to hold true today.

Australia's Economic Recovery and Access to Small Business Finance

Economic conditions for many small businesses in Australia began to improve in the second half of 2020 alongside the broader recovery from the severe economic disruption caused by the COVID-19 pandemic. While small businesses' access to finance from lenders tightened in the early stages of the pandemic, various policy measures were provided to help support the provision of credit. However, lending to small businesses remains little changed. Businesses have been reluctant to take on more debt in an uncertain environment and, at the same time, many have been able to make use of a range of temporary measures that have supported revenues or allowed for deferral of payments.

Developments in Banks' Funding Costs and Lending Rates

Banks' funding costs declined to historical lows over 2020, reflecting the monetary policy measures announced by the Reserve Bank. In aggregate, lending rates have fallen in line with banks' borrowing costs, such that the major banks' average interest spreads were little changed over the year.

Developments in the Buy Now, Pay Later Market

The buy now, pay later (BNPL) sector is growing rapidly and new providers and business models are emerging. While the development of these new payment services is evidence of Australia's innovative and evolving payments system, it may also raise issues for policymakers. The Reserve Bank is currently considering policy issues raised by BNPL providers' no-surcharge rules as part of its Review of Retail Payments Regulation. This article discusses developments in the BNPL sector, focusing on different business models and implications for the cost of electronic payments to merchants.

Determinants of the Australian Dollar over Recent Years

The exchange rate is influenced by a number of domestic and international factors. Two key fundamental determinants of the exchange rate are the terms of trade and differences between interest rates in Australia and those in major advanced economies. Since the end of the mining boom, the decline in the terms of trade and easing in domestic monetary policy, including the recent introduction of quantitative easing measures, have contributed to the depreciation of the Australian dollar. On a shorter-term basis the Australian dollar has also moved closely with prices in other international financial markets in response to changes in global risk sentiment.

Understanding the East Coast Gas Market

Wholesale gas prices on the east coast have become linked to LNG export prices since 2015. This is because local gas producers can now sell into international markets through the 3 Queensland LNG export terminals. Wholesale prices will continue to be influenced by LNG export prices as long as this option is available. Contracted prices apply to the bulk of east coast gas demand and production. Contracted gas prices are likely to remain structurally higher than their pre-2015 levels over coming decades, reflecting higher marginal costs of domestic production.

The Response by Central Banks in Emerging Market Economies to COVID-19

The COVID-19 health and economic crisis has severely affected emerging market economies (EMEs). As a result, emerging market central banks have employed a wide range of tools to support their economies and financial systems, many of which have been used for the first time. These measures have helped to support the functioning of domestic financial markets, lower domestic interest rates and facilitate the flow of credit to households and businesses. The scale of monetary easing by EME central banks was larger, and the pace faster, than in some past crisis periods. This was influenced by the sudden and synchronised nature of the COVID-19-induced economic shock and the large scale policy response in advanced economies that occurred alongside the EME response. It also reflects the significant improvements emerging market central banks have made to their institutional frameworks over recent decades and the development of EME financial markets over the same period.

The graphs in the Bulletin were generated using Mathematica.

ISSN 1837-7211 (Online)