Assessment of ASX Clearing and Settlement Facilities 3. Special Topic – Margin

3.1 Introduction

During the assessment period, the Bank conducted a detailed review of the ASX CCPs' margin arrangements against the FSS. This chapter summarises the Bank's findings and recommendations.

Margin is a key component of a CCP's approach to managing financial risk. In the absence of a participant default, CCPs operate a ‘matched book’, meaning that for any position they hold with one clearing participant, they hold an equal and opposite position with another. This means a CCP has no direct exposure to price movements in the products it clears. However, in the event of a default, the CCP must assume the obligations of the defaulting participant – and therefore the risk of adverse price movements on its portfolio – until the CCP is able to close out those positions. The regular collection of margin from participants creates the first layer of financial resources used by CCPs to mitigate the risk of default-related losses.

CCPs collect two main types of margin:

- Variation margin is collected to prevent the build-up of current exposures between a CCP and its participants as prices move. For example, a CCP will call variation margin from a participant whose long position in a product has declined in value as prices fall; the CCP will typically pay out an equivalent amount to participants with short positions that have gained in value.

- Initial margin is collateral collected from participants to cover potential future losses in the event of a participant default. It is calibrated to cover potential exposures from price changes occurring between the last payment of variation margin (when the CCP's current exposures to participant portfolios are brought down to zero) and when the defaulting participant's portfolio is closed out.

Both types of margin are collected either daily or several times per day, depending on the product, either at fixed intervals or in response to significant market movements. Initial margin represents the majority of collateral held by the ASX CCPs to mitigate possible losses from a participant default. At the end of the Assessment period the CCPs collectively held around a total of $10.2 billion in margin and $900 million in other (mutualised) financial resources (see Appendix B.3).

The end-to-end risk coverage of a CCP's margin arrangements depend on the settings of the overall margin system. For example, the amount of initial margin that must be held by a CCP will depend on the frequency with which it collects variation margin, the calibration of its initial margin parameters, and the settings of related systems that underpin the calculation, collection and investment of margin (including its collateral management policies).

3.2 Variation margin

CCP Standard 6.4 requires CCPs to mark participant positions to market and collect variation margin at least daily to limit the build-up of exposures as prices change. The ASX CCPs collect different types of variation margin to cover these exposures depending on the product (Table 4).

| Clearing house | Product | Margin name | Timing | Margin collection |

|---|---|---|---|---|

| ASX Clear | Cash equities and warrants | Mark-to-market Margin | Daily | Added to or offset against the participant's posted initial margin. |

| ASX Clear | Exchange-traded options (ETOs) | Premium Margin | At least daily | Collected from participants with net short positions, and held by ASX. |

| ASX Clear | Low-exercise-price options (LEPOs) | Variation Margin | At least daily | Collected from and paid to participants. |

| ASX Clear | Interest-rate securities* | N/A | None | No variation margin collected. |

| ASX Clear (Futures) | All | Variation Margin | ** | Collected from participants with a mark-to-market loss and passed on to participants with a gain. |

|

* For example, retail depository interests in corporate bonds or government

securities. |

||||

3.3 Initial margin

CCP Standard 6.3 states that CCPs should use initial margin models that generate margin requirements sufficient to cover their potential future exposure to participants and appropriately account for relevant risk factors of the products cleared.

For any initial margin model, a CCP must set three key parameters:

- Confidence interval. The target level of coverage of initial margin over potential future exposures. The FSS require that a CCP target initial margin to meet a single-tailed confidence level of at least 99 per cent of the estimated distribution of future exposures for exchange-traded products, and 99.5 per cent for OTC products.[13]

- Historical sample period. The sample of historical data used to estimate the model.

- Margin period of risk (MPOR). Also known as the close-out period, this is the estimated maximum length of time between the receipt of the last variation margin payment from a defaulting participant, and the point at which all of that participant's positions have been closed out. That is, it is the period in which the CCP is exposed to potential losses on a defaulting participant's portfolio.

Initial margin models can have varying degrees of structure. That is, they can be primarily statistically driven, with a limited number of assumptions, or include a greater number of parameters that must be set in order to generate margin calculations. The choice of model type involves a range of trade-offs (see Box B).

3.3.1 Margin models at the ASX CCPs

The ASX CCPs use four different methodologies to calculate base initial margin requirements for participants across its range of products (Table 5).

For exchange-traded derivatives (ETD) transactions, ASX Clear and ASX Clear (Futures) calculate initial margin requirements using the CME SPAN methodology. Margin requirements in SPAN are largely determined by the setting of key parameters. These include the price scanning range (PSR) and the volatility scanning range (VSR), which model potential changes in price and implied volatility. Both CCPs review and recalibrate CME SPAN margin parameters on at least a quarterly basis.

| Clearing house | Product | Margin model | Historical sample period | Confidence interval (per cent) | MPOR | Initial margin(a) |

|---|---|---|---|---|---|---|

| ASX Clear | Cash Equities | HSVaR | 5 years | 99.7 | 2 days | $127m |

| ASX Clear | Cash Securities | Flat rate | Up to 5 years | 95, 99.7(a) | 2, 3 days(b) | $211m |

| ASX Clear | ETDs | SPAN | Highest requirement from 1 year or 5 years | 99.5 | 3 days | $1,110m |

| ASX Clear (Futures) | Liquid ETDs | SPAN | 5 years(c) | 99.5 | 2 days | $6,739m |

| ASX Clear (Futures) | Less liquid ETDs(d) | SPAN | 5 years(c) (10 years for electricity caps) | 99.5 | 3 days | |

| ASX Clear (Futures) | OTC | FHSVaR | Back to June 2008 | 99.7 | 5 days(e) | $711m |

|

||||||

To calculate margin requirements for OTC derivatives, ASX Clear (Futures) uses a filtered historical simulation value-at-risk (FHSVaR) model. Value at risk (VaR) models use a distribution of simulated changes in the value of a portfolio to calculate the potential loss at a given confidence level. In a FHSVaR model these changes are ‘filtered’ or scaled using a volatility scaling factor to more closely reflect the current level of market volatility (e.g. if volatility is high relative to previous periods, price changes from previous periods may be scaled up).[14] ASX takes a conservative approach by extending the historical sample period back to the period of stress in the second half of 2008.

ASX Clear uses two models to margin cash equities and other cash market products, as part of its overarching cash market margining (CMM) model:

- A historical simulation value at risk (HSVaR) model, used for securities in the ASX 500 All Ordinaries index with more than five years of continuous price data.[15] There is no filtering of historical volatility in the CMM model since the shorter historical sample period means that there is a greater weight on recent volatility.

- Flat rates are used for all remaining cash market products. Flat rates are intended to cover two-day price moves within a 99.7 per cent confidence level at the cash securities portfolio level. ASX assigns individual flat rates for securities in the All Ordinaries index, while other securities are grouped with broadly similar products and assigned a common flat rate.

ASX also collects margin ‘add-ons’ to account for certain idiosyncratic risks (e.g. portfolio concentration and size) which are not captured by its initial margin models (see section 3.3.4). These risks are captured outside of the base margin requirements to allow ASX to better target their coverage, thereby differentiating between products and positions to which these risks apply and those to which they do not.

BOX B: Types of Initial Margin Models

While parameter-based and the more statistically driven VaR-based margin models have different risk characteristics, neither model type is inherently biased towards higher or lower margin requirements. In both cases the level of margin produced by the model will depend on the choice of MPOR, target confidence level and historical sample period, and how these interact with market conditions. The main trade-offs between these models are rather in the dimensions of flexibility, transparency and scalability.

– Parameter-based models provide CCPs with greater flexibility to influence model outcomes by adjusting intermediate parameters. For example, parameters could be constrained or adjusted to reflect risks that are hard to quantify or to cover the possibility that future risks may be different from those captured by historical data. CCPs should have robust governance arrangements in place to ensure that this flexibility is exercised appropriately (see section 3.7.1). The same outcomes are difficult to engineer for VaR models without the need for add-ons that can add complexity to the model (see section 3.3.4).

– The assumptions behind VaR models and potential add-ons can be simpler to communicate, since they do not rely on intermediate parameters. However, it can be harder to understand how changes to volatility or positions feed through to margin outcomes. Parameter-based models, on the other hand, can separately specify how volatility and offsetting risk positions influence margin requirements.

– The calibration of a parameter-based model is more practicable when products are standardised (e.g. futures). In contrast, VaR models have historically been preferred for less standardised products such as OTC derivatives. More recently, VaR models have become increasingly common in part to meet the growing diversity and complexity of cleared products as well as the evolution of risk management practices.[16]

3.3.2 Margin model review program

ASX is currently in the process of implementing a multi-year work plan to review many of its key margin models and systems. In the assessment period, ASX began upgrading its OTC derivative margining systems, as well as planning for cash market model upgrades. ASX should ensure that any revised models that emerge from its review program meet the FSS requirement for a CCP's risk management framework to be coherent and consistent (e.g. by making sure products with similar risk characteristics are treated similarly).[17] ASX should also take into account industry best practice consistent with its Model Validation Standard (see section 3.9.3).

The review also provides opportunities for ASX to enhance the transparency of its margin models to participants. While ASX currently makes available most of the information required for participants to recreate the outputs from its base margin models, this does not include some add-on requirements that ASX considers to be proprietary. Some international CCPs have begun taking steps to increase the transparency of their margin requirements – for example, by using open source models or allowing participants to estimate margin requirements via an application programming interface (API).

Recommendation: ASX should develop and implement a plan to review its margin methodologies and systems that takes into consideration international best practice and is designed to produce coherent and consistent risk outcomes from its margin models that are transparent to participants. ASX should discuss its implementation plan with the Bank by 30 September 2023.

3.3.3 MPOR

CCP Standard 6.3 requires CCPs to conservatively estimate the time it might take to close out or effectively hedge a defaulting participant's positions, including in stressed market conditions (i.e. the MPOR).

The 2020 Assessment recommended that ASX review the consistency between its MPOR assumptions and its operational capacity to close out portfolios across all of its asset classes simultaneously. To address the outstanding recommendation, ASX conducted an analysis of the sequencing of actions required to manage the default of a participant with a large and diverse portfolio (i.e. that would require ASX to conduct multiple default auctions). The analysis looked at how the timing of the auctions could be feasibly staggered across a number of days. ASX concluded that the current MPOR settings for individual product groups are consistent with the time it would take to liquidate large and diverse portfolios based on likely default management actions, and will continue to monitor this via its default management procedure review.

The Bank has identified one inconsistency in ASX Clear's MPOR settings. The CCP clears a range of interest rate securities for which it does not collect variation margin. The level of activity in these securities is low, representing less than 0.1 per cent of average initial margin over 2021/22. Nevertheless, ASX Clear is exposed to up to two days of mark-to-market losses between the point at which trades in these securities are struck and the point at which the trades are settled. This effectively increases the MPOR on these trades by two days. However, ASX does not use a higher MPOR for these products than it does for comparable products for which variation margin is collected.

Recommendation: ASX Clear should ensure that its MPOR for securities products is consistent with its approach to mark-to-market margin for these products.

3.3.4 Initial margin add-ons

CCP Standard 6.1 requires that margin levels are commensurate with the risks and particular attributes of each product, portfolio and market that the CCP serves. ASX uses a range of margin add-ons to capture more specific risks.

Concentration risk add-ons

In a default scenario, market liquidity can affect the CCP's ability to close out a participant's portfolio in an orderly manner. ASX calls for margin add-ons from clearing participants with concentrated portfolios that are considered more difficult to liquidate. In particular, portfolios that are sufficiently large relative to market turnover will likely take longer to close-out than the MPOR, meaning that the CCP is exposed to adverse price movements for longer. In order to cover this risk without penalising participants with smaller positions, ASX charges participants with larger portfolios a range of add-ons. These include an OTC Liquidity Add-on for larger OTC portfolios, and a ‘scaler’ (i.e. multiplier) used to calibrate margin parameters on larger ETD portfolios at ASX Clear (Futures).

Market liquidity risk add-ons

CCPs also face the risk that specific products are not sufficiently liquid to close out the positions of participants even when they do not have unusually large positions within the assumed MPOR. This can be addressed through liquidity risk add-ons, as well as through a review of the MPOR assumptions.

The 2017 Assessment included a recommendation for ASX Clear to review the need for add-ons to manage liquidity risk in cash market products and ETOs. ASX has concluded that liquidity add-ons for ETOs are not needed, taking into account a survey of market participants to understand their capacity to acquire a large defaulted portfolio, but is yet to begin its review for cash market products. Going forward, ASX will conduct regular analysis to assess the need for liquidity add-ons for ETOs. ASX plans to complete its review of liquidity add-ons for cash market products by June 2023.

Recommendation: ASX Clear should complete its review of add-ons to manage liquidity risk for cash market products and implement these add-ons if the review concludes they are needed (see Table 6, Appendix A).

3.3.5 Portfolio margining and offsets

CCP Standard 6.5 states that a CCP may allow offsets or reductions in margin across products that it clears if the risk of one product is significantly and reliably correlated with the risk of the other product. Most of ASX's margin models permit some form of offset, except for flat rate margin.

ASX's VaR-based models for cash market products and OTC derivatives calculate margin using the historical distribution of changes in a portfolio's value over the historical sample period. Historically observed price correlations between products will be reflected in this distribution, reducing margin requirements relative to a purely product-by-product calculation.

The CME SPAN model allows for margin offsets between related contracts via the inter-commodity spread concession (ICC) parameter. The ICC reduces margin requirements across product pairs to account for diversification benefits where reliable correlations are observed across related contracts. ICCs are calibrated using a one-year historical sample period and an MPOR consistent with the one used to calibrate the related PSRs. ICCs are reviewed quarterly and subject to sensitivity analysis by calculating the impact of a complete erosion of underlying correlations, with the maximum concession generally capped at 80 per cent.

ASX Clear (Futures) participants that have both OTC and exchange-traded interest rate derivatives products in their portfolio are able to hold both products in a common portfolio for margining purposes (under the FHSVaR model).[18] ASX's Margin Optimiser model is used to determine the optimal allocation of interest rate futures.[19]

3.4 Measures to address procyclicality

Increasing margin requirements during periods of market stress can create liquidity challenges for a CCP's participants. Such increases can be considered ‘procyclical’ if they tend to occur during downturns in the business or credit cycle or during periods of market stress, and may either cause or exacerbate market instability. This risk has been an area of focus among regulators in recent years, and the CPMI-IOSCO CCP Resilience Guidance encourages CCPs to put in place measures to maintain higher initial margin requirements through the cycle in order to avoid sudden increases in times of stress.[20]

These measures can involve CCPs placing a floor on margin requirements or ensuring – even during periods of low volatility – that their margin calculations take into account earlier episodes of stress. A CCP can also use expert judgement to identify emerging risks and pre-emptively increase margin to avoid the need for increases at the time that these risks crystallise, when participants may be under greater stress. The 2020 Assessment recommended that ASX develop a systematic framework designed to avoid destabilising increases in margin and other financial risk requirements during periods of heightened market volatility.[21]

During the assessment period, the ASX CCPs completed the introduction of margin floors for all products margined using SPAN.[22] ASX Clear (Futures) also applies a floor (at 50 per cent) to the volatility scaling factor in the OTC FHSVaR margin model, which limits the extent to which margin requirements are reduced in low volatility conditions.

While the implementation of margin floors reduces the risk of destabilising increases in margin during periods of heightened market volatility, it does not constitute the systematic procyclicality framework needed to reduce this risk across all margin and financial risk requirements at the ASX CCPs. In particular, a comprehensive framework should cover margin floors or other measures to address procyclicality for all remaining contracts at both CCPs, as well as non-margin risk requirements such as collateral haircuts. The framework should include an appropriate methodology for measuring the degree of procyclicality in risk models to allow management and the CS Boards to assess the adequacy of tools employed by the CCPs to address procyclicality.

ASX should also consider the impact of expert judgement decisions within this framework, for example when overriding the application of tools such as margin floors, or the potential to use expert-judgement driven forward-looking scenarios to anticipate future increases in margin requirements (see section 3.7.2).

Recommendation: Consistent with the CCP Resilience Guidance, by 30 June 2024 the ASX CCPs should develop a systematic framework to avoid destabilising increases in margin and other financial risk requirements during periods of heightened market volatility. This framework should include an appropriate methodology for measuring the degree of procyclicality in the CCPs' risk models and should consider the potential effect of expert judgement on procyclicality when determining margin and other financial risk requirements.

3.5 Intraday and overnight margin

CCP Standard 6.4 requires that CCPs have the authority and operational capacity to make and settle intraday margin calls and payments, both scheduled and unscheduled, to participants. In considering the timing of intraday calls, CCP Standard 6.8 requires that CCPs consider the operating hours of payment and settlement systems in the markets in which they operate.

Collecting intraday margin allows CCPs to mitigate build-ups in risk exposures over a trading session from changes in participants' net positions (by collecting initial margin) and from price movements (by collecting variation margin).

In selecting the appropriate number of margin calls to schedule and make per day, CCPs must weigh the financial risk management benefits of more frequent collection against the operational costs and risk this can create.[23] The selected frequency of margin calls will also impact the calibration of other margin settings (e.g. MPOR).[24]

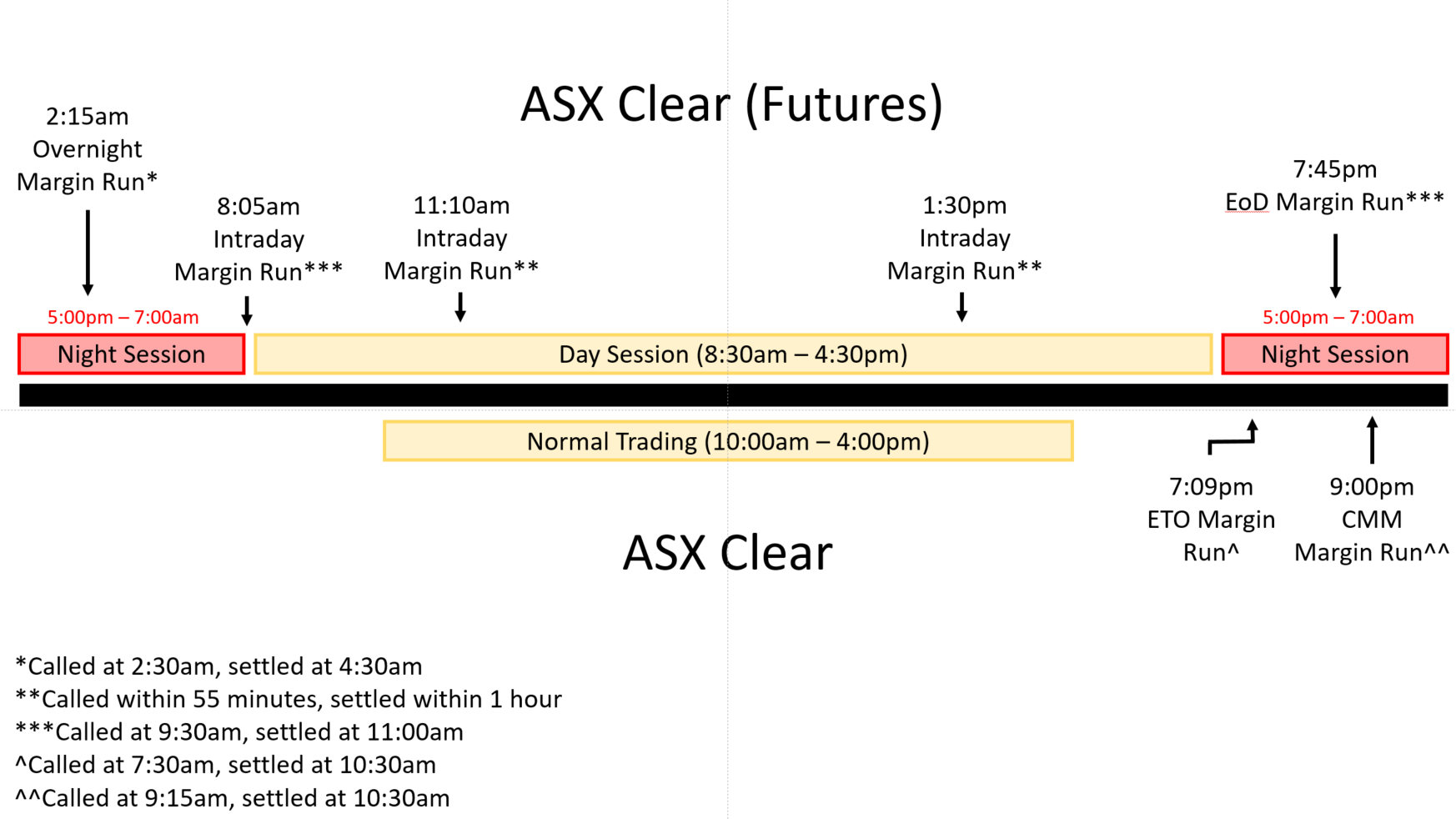

ASX Clear and ASX Clear (Futures) have different processes for managing intraday exposures reflecting differences in the materiality of intraday changes in exposures and the operating hours of the two CCPs (Figure 1). In both cases the CCPs will only call margin from a participant on an intraday basis if the calculated margin shortfall exceeds certain thresholds based on the relative size of the shortfall or ASX's assessment of the creditworthiness of the participant.

3.5.1 ASX Clear intraday margin processes

ASX Clear does not schedule regular intraday margin calls, but an ad hoc call will be calculated if equity price movements are sufficiently large (the current trigger is an increase/decrease of 1 per cent or more in the S&P/ASX 200 index).[25] During periods of heightened volatility (including during ETO expiries), ASX Clear undertakes ad-hoc reviews of cash market developments three times per day, which can lead to an intraday call if exposures become elevated. Once ASX Clear makes an intraday margin call, participants have two hours to settle the necessary collateral.

3.5.2 ASX Clear (Futures) intraday margin processes

ASX Clear (Futures) offers clearing services 24 hours per day, from Monday morning to Saturday morning, and so it faces intraday risk overnight as well as during the day.

Day Session (8:30 am – 4:30 pm)

ASX Clear (Futures) has three scheduled intraday margin runs during its Day Session. ASX Clear (Futures) also recalculates margin on ETDs and OTC derivatives hourly, and may conduct ad-hoc margin calls during the Day Session if the ASX Clearing Risk team's senior management conclude that market movements have been sufficiently large, such as during periods of heightened volatility. Intraday margin calls must be met by participants within one to two hours of notification, depending on the timing of the call and whether or not it was scheduled.

Night Session (5:10 pm – 7:00 am)

ASX Clear (Futures) also conducts an overnight call (shortly after 2am) for margin from certain participants.[26] This call is based on the change in margin requirements since the last intraday run and originally included only initial margin to mitigate exposures created during ASX 24's Night Session. ASX Clear (Futures) started collecting overnight variation margin in April 2022 (section 3.5.3). The call must be settled by participants in US dollars (USD) using commercial settlement banks within two hours.[27]

3.5.3 Late-in-day and overnight price movements

In the 2020 Assessment, the Bank recommended that the ASX CCPs should put in place arrangements that allow them to monitor and manage exposures arising from late-in-day and overnight price movements.

While ASX Clear (Futures) has now commenced the collection of overnight variation margin in USD, this approach generates a credit exposure to the commercial settlement banks used to settle these payments. This exposure is unwound following the first intraday margin run in Australian dollars (AUD) the next morning. If a commercial settlement bank was to default, any losses would be allocated to ASX and its participants as set out in the ASX Recovery Rules.[28]

ASX Clear (Futures) plans to investigate alternative longer-term solutions to collect overnight variation margin that do not involve credit exposure to commercial settlement banks. These options include using alternative collateral (such as government securities) or using the New Payments Platform to settle payments in AUD via exchange settlement accounts at the Bank. Although an AUD solution would present a range of challenges, including the management of overnight AUD liquidity requirements by participants, it is preferable from a risk management perspective to settle margin obligations in the same currency as the related exposures.

Both CCPs will need to make further progress in implementing arrangements to monitor and manage exposures arising from late-in-day price movements.

Recommendation: The ASX CCPs should put in place arrangements that allow them to monitor and manage exposures from large late-in-day price movements, including movements that exceed the coverage provided by initial and additional margin. By 30 June 2023 ASX should review the feasibility of options to address this recommendation and develop a plan to implement option(s) found to be feasible.

Recommendation: By 30 June 2023 ASX Clear (Futures) should review the feasibility of options to remove or mitigate exposures to commercial settlement banks arising from overnight margin processes and develop a plan to implement option(s) found to be feasible.

3.6 Pricing

CCP Standard 6.2 requires that CCPs have a reliable source of timely price data for their margin system, and have procedures and sound valuation models for addressing circumstances in which pricing data are not readily available or reliable.

ASX Clear and ASX Clear (Futures) have access to timely price data for the products that they clear (Table 6).

| Clearing house | Product | Pricing source | Pricing type examples |

|---|---|---|---|

| ASX Clear | Cash equities | ASX Trade | Traded prices (i.e. settlement auction for the daily settlement price). |

| Exchange traded derivatives | ASX Trade | Traded prices where available, otherwise extrapolated prices from previous pricing periods or untraded bids and offers. For less liquid stock options, ASX's Derivatives Pricing System compares calculated prices against trades in similar options. | |

| ASX Clear (Futures) | Exchange traded derivatives | ASX Trade 24 | Daily settlement (and intraday) prices based on traded prices. Final settlement prices (at contract expiry) calculated in accordance with the respective contract specifications, typically with reference to underlying spot markets. |

| OTC derivatives | Third-party data providers | The clearing system prices interest rate curves using the official cash rate and other pricing points provided through third parties. Prices are subject to second source validation. Participants are given information needed to create an end-of-day yield curve and calculate the net present value of contracts. |

ASX has procedures and contingencies in place for situations in which prices are not available or are deemed to be unreliable (for example, during a market outage). For example, for cash market securities and ETOs, ASX makes use of alternate trading venues such as Cboe Australia or estimation based on market indexes such as S&P/ASX200. In addition, ASX can also use the last available trading price or the closing price from the previous day.[29]

ASX runs a set of checks and validations for its price data each day to ensure they are correct. These include comparing daily price movements against predefined tolerance levels and independent third-party data, and automated alerts where pricing algorithms produce results outside set rules or parameters. Market participants are also given the opportunity to query calculated settlement prices ahead of interim market settlement.

3.7 Expert judgement

As with any predictive model, margin models rely on simplifying assumptions and are therefore subject to model risk. Where there is evidence that the model's assumptions may be violated (e.g. where future price volatility is expected to significantly differ from the historical sample period), there may be a case for manual adjustment of margin model outputs (including intermediate outputs such as the PSR). This use of expert judgement by a CCP's management can help to ensure that a margin system establishes margin levels commensurate with the relevant risks and particular attributes of each product, portfolio and market it serves (see Standard 6.1).

Although expert judgement can play an important role alongside its margin models, the use of expert judgement should be appropriately governed to ensure that it is used judiciously and should seek to limit destabilising procyclical changes to initial margin by taking a forward-looking view. The application of expert judgement should also not be used to address systematic margin model shortcomings. Among other things, it is difficult for clearing participants to properly anticipate changes in margin when driven by the use of expert judgement (see section 3.9.4).

3.7.1 Governance

The use of expert judgement to override margin model outputs can potentially constitute a material adjustment to the margin methodology and parameters. It is therefore important that the use of expert judgement is subject to appropriate governance processes (see paragraph 6.7.1 of guidance to the CCP Standards). The CCP's board is ultimately responsible for material risk decisions and for ensuring that there is adequate governance surrounding the adoption and use of margining models (see paragraphs 2.3.1 and 2.6.4 of guidance to the CCP Standards).

The ASX CS Boards have delegated authority to the Chief Risk Officer (CRO) to make non-material changes to margin. Any such changes are typically made as part of the quarterly review of margin model outputs and backtesting results by the Risk Quantification Working Group (RQWG).[30] However, changes may also be made on an ad-hoc basis if deemed necessary, for example if urgent changes are required to respond to market stress.

The CS Boards have sole authority to approve material changes to margin requirements at the ASX CCPs. However, the significant expert-judgement driven changes to margin in March 2020 (see Box C) were made without prior approval from the CS Boards, which would have been impractical given the fast-evolving risk environment. ASX management subsequently informed the CS Boards of the overall margin changes but directors were not told how much of the change was due to the application of expert judgement.

During the assessment period, the CRO approved a new margin decision framework for ASX Clear (Futures) to clarify the situations under which expert judgement may be used to make margin changes. This includes where backtesting results or forward-looking market risk measures suggest the need for a change in margin levels. The framework formalises the procedures that were already followed by the ASX CCPs in practice, and ASX has begun extending the framework to ASX Clear. However, this framework does not distinguish between material and non-material changes to margin, indicate who is required to approve these, or set out a process for independent challenge and review of expert judgement decisions.

While it is important that the ASX CCPs are able to make changes to margin in a timely manner, particularly when market conditions are evolving quickly, the process involved in making urgent margin changes and the respective roles of management and the CS Boards should be clear. Consistent with the recommendation below, the ASX CCPs should ensure that roles and processes in relation to the governance of expert judgement are appropriately formalised and documented.

Recommendation: To align financial risk management practices and governance arrangements with the CCP Resilience Guidance, the ASX CCPs should continue to implement plans to: […] ensure that roles and processes in relation to the governance of financial risk management are appropriately formalised and documented in order to ensure that the CS Boards have sufficient information to effectively oversee the CCPs.

BOX C: Examples of ASX's Use of Expert Judgement

March 2020 increases in margin requirements

The onset of the COVID-19 pandemic resulted in heightened volatility across financial markets. The S&P/ASX 200 VIX, which measures anticipated near-term volatility in the Australian equity market, rose from around 10 per cent to 26 per cent by 28 February 2020 and then to 42 per cent by 13 March.

ASX responded by increasing initial margin settings beyond the level suggested by the purely statistical output of its margin models. This reflected ASX's judgement that market volatility would remain above the level in SPAN's historical sample period for some time. As a result:

– On 13 and 31 March, the SPAN PSR parameters were increased for equity index futures and options, increasing total initial margin held at ASX Clear (Futures) by a cumulative $1.7 billion (20 per cent).

– On 19 March, the MPOR for single stock ETOs cleared by ASX Clear was increased from two to five days. On average initial margin coverage increased by five percentage points.

By November 2020, the statistical output of margin models caught up with the level set by expert judgement and margin levels returned to being model-determined.

Margin floors on interest rate futures

In May 2021, ASX Clear (Futures) introduced margin floors for major futures contracts. While these floors were primarily model-determined, ASX used expert judgement to override the floors for interest-rate futures contracts affected by the Bank's monetary policies at the time. It was ASX's expectation that these policies would mean volatility on products referencing interest rates up to three years would remain very low for some time. ASX concluded that the cost of maintaining higher margin floors through the period would have negatively affected market activity, concentration levels and liquidity in these products.

This decision resulted in margin coverage falling below model-determined floors for a range of short-medium term rates contracts.[31] In parallel, ASX introduced two hypothetical credit stress-test scenarios to address the possibility of a sudden increase in volatility.

In July 2021, ASX communicated triggers for a transition back to model-determined floors to participants. As a result, the margin floors on affected contracts were increased to their model-determined levels between September 2021 and November 2021, when the Bank's three-year AGS yield target was discontinued.

3.7.2 Procyclicality and the use of expert judgement

While the use of expert judgement to adjust margin coverage during periods of market stress may help to ensure that margin requirements remain sufficient, such increases can be destabilising (see CCP Standard 6.3). Similarly expert judgement could increase the procyclicality of margin requirements if used to override measures, such as margin floors, that are designed to prevent margin levels from falling too low during less volatile periods. On the other hand, expert judgement can be used in a way that reduces procyclicality, for example by maintaining higher margin requirements than those produced by models if there is a plausible risk of increased market volatility.[32] This would reduce the need for a sudden change in margin requirements if volatility subsequently increased.

The examples in Box C highlight recent cases in which the application of expert judgement at the ASX CCPs has increased the potential procyclicality of margin requirements. For example, the large increases in initial margin in March 2020 occurred around the peak in market volatility. If some of this increase had been implemented earlier – for example, when volatility began to increase in late February or during the period of historically low volatility that preceded this – the increase required at the time of peak market stress could have been significantly smaller.

While it is not possible for CCPs to predict changes to market conditions with confidence, they can examine the impact of plausible scenarios on margin requirements. For example, the forward-looking components of ASX's margin decision framework could be enhanced with consideration of plausible historical or hypothetical scenarios (e.g. the impact of known or potential events such as elections or geopolitical conflicts). Additional forward-looking analysis could help ASX identify and quantify emerging risks at an earlier stage and adjust margin as required before these risks crystallise.

The Bank has already identified the need for the ASX CCPs to develop a systematic framework to limit procyclicality in their risk models (see section 3.4). This framework should consider the potential effects of the use of expert judgement on procyclicality.

3.8 Margin systems and processes

The ASX CCPs use a range of related systems and processes to support their margin operations:

- Upstream systems and processes are used to calculate participants' margin requirements. This includes the data feeds for product prices and participant positions as well as systems used to calculate margin requirements based on these inputs.

- Collateral management systems, which aggregate margin requirements, compare these to the value of collateral posted for each participant, and generate notifications to participants of any margin payments due.

- Downstream systems and processes that ASX and clearing participants jointly use to post collateral to settle margin obligations.

3.8.1 Operational reliability, recovery and backup procedures

CCP Standard 16 requires that a central counterparty should identify and mitigate plausible sources of operational risk. This includes designing systems to ensure a high degree of operational reliability, and having effective arrangements in place for timely recovery of operations in the event of a major disruption. Given the central role that margin systems play in underpinning CCP risk management, it is of critical importance that these systems are resilient and supported by strong recovery and contingency arrangements to maintain a continuous operational capacity to make margin calls.

Over the assessment period, ASX experienced some system and process incidents related to its margin operations. Some of these incidents had external impacts, such as a delay in issuing a margin call or the issuing of a call in error. In the next assessment period, the Bank will discuss with ASX the processes and controls it uses to help ensure the operational reliability of its margin-related operations. The Bank will also engage further with ASX on its backup procedures in the event of an outage affecting the systems it uses to calculate and collect margin balances due.

Area of Supervisory Focus: The Bank will discuss with ASX the processes and controls it uses to help ensure the reliability of its margin-related operations, as well as its backup procedures in the event of an outage affecting the systems it uses to calculate and collect margin.

Contingency procedures

ASX conducts disaster recovery tests for each of its main margin systems every 12 to 24 months. ASX's timeframe for executing a cut-over to its secondary data centre is two hours from the time that its technology teams are advised to initiate the process. In addition, ASX has backup procedures to mitigate risks in the event that recovery is delayed.

- Margin inputs and calculations. The ASX CCPs have well-defined backup procedures for determining prices in the event of a market outage or closure, and can access participant positions through multiple systems. In case of a SPAN outage, both CCPs could compute margin manually using the ‘PC SPAN’ system and use ad-hoc procedures to call margin on this basis.

- Collateral management systems. In case of an outage, ASX would manually collate relevant data on collateral holdings, margin requirements and any resulting margin balances due. Participants can receive information on their margin obligations via email, CHESS message (at ASX Clear) or by checking the ASX settlement instructions in Austraclear.

- Margin settlement systems. If ASX's Clearing Operations team were unable to access the standard Austraclear interface to complete margin settlements, ASX's internal Austraclear team could perform an assisted transaction on their behalf. If Austraclear as a whole were to become unavailable, ASX would seek to settle AUD margin directly via RITS. In the event that real-time settlement in RITS was unavailable, Austraclear could be operated in Assured Mode, which allows for deferred net settlement of Austraclear payments.

3.8.2 Late margin payments

CCPs should establish and rigorously enforce timelines for margin collections and payments and set appropriate consequences for failure to pay on time (paragraph 6.4.2 of guidance to the CCP Standards). While the vast majority of margin payments are collected on time, ASX has procedures in place to investigate, and in some cases sanction, participants for late margin payments.

Late payments are usually the result of operational issues experienced by the clearing participant, a settlement bank or ASX. However, they could also be a sign of financial issues at the clearing participant. If ASX concludes the event represents a breach of the relevant CCP's Operating Rules, the breach may be referred for enforcement action. In more serious cases, including where financial stress is suspected, ASX's Participant Issue Response Group (PIRG) would consider the issue. In the event of a possible participant default, the PIRG would escalate the issue further to ASX's Default Management Committee.

3.9 Review and validation

CCP Standards 6.6 and 6.7 set out requirements for CCPs to analyse and monitor model performance and overall margin coverage through backtesting and sensitivity analysis, and to regularly review and validate their margin systems.

3.9.1 Backtesting

Backtesting is used to compare actual model performance with predicted model outcomes. In practice, it involves the comparison of the number of breaches in margin coverage observed over a certain period (e.g. the previous year) against the number of breaches expected for each margin model based on its calibration assumptions. ASX conducts daily backtesting of the SPAN, CMM and the OTC FHSVaR margin models to test whether the margin models reliably cover price movements to a 99.5 per cent confidence level for exchange-traded derivatives and 99.7 per cent for all other products. ASX also backtests key model parameters, including the PSR and VSR in CME SPAN, and flat rates for cash market products. Reporting is reviewed by the RQWG and used to identify the need for further investigation of margin model performance. For example, in June 2022, backtesting outcomes for the OTC FHSVaR margin model fell below the 99.5 per cent confidence level; as a result, ASX adjusted the model to increase margin requirements.

During the assessment period, ASX identified some inconsistencies between backtesting and modelling assumptions in its existing infrastructure. For example, for some products, the MPOR assumed for the calculation of initial margin was found to be different from the MPOR used in backtesting. ASX reviewed the effect of these errors on reported backtesting outcomes and did not identify any material breaches. ASX plans to complete work to enhance its backtesting systems over the next assessment period.

3.9.2 Sensitivity analysis

While backtesting tests whether a model is performing as intended under its current assumptions, it is also important to examine the effects of relaxing these assumptions via sensitivity analysis. ASX assesses the sensitivity of margin requirements to changes in key margin settings, including the MPOR, historical sample period and confidence interval. ASX also conducts ‘reverse sensitivity analysis’ on CME SPAN margin models, which examines the conditions under which target initial margin coverage would be breached. ASX performs its sensitivity analysis on at least a monthly basis and the findings are considered by the RQWG.

ASX primarily uses the one-factor-at-a-time approach, which involves moving one input variable at a time while keeping the others at their baseline values. This approach is generally less suitable for non-linear models or for historical or hypothetical scenario analysis. ASX does perform a limited set of multi-parameter sensitivity tests and plans to do further work to incorporate non-linearities as part of the scope of the ongoing margin model review program.

3.9.3 Model validation

ASX's Model Validation Standard requires that all margin models undergo a full annual validation and ongoing review. The RQWG is responsible for overseeing the regular reviews of models carried out by the Clearing Risk Quantification and Development (CRQD) group, while Internal Audit coordinates the independent third-party validation process with CRQD input.

Internal Audit reports the results of independent validations to the Risk Committee, Audit and Risk Committee and the CS Boards. These annual validations examine the conceptual soundness and performance of the models. A validation of conceptual soundness is also required when a model is materially changed. In addition, all new models and changes to existing models are subject to internal peer review to ensure development is compliant with the relevant model documentation, internal development standards and requirements documentation.

All margin models were externally validated during the assessment period. The main models were found to be conceptually sound with no material limitations identified. However, the review identified a number of low-rated findings on the quality of documentation.

As a second component of the independent model validation process, Internal Audit review whether models are operating as intended in practice. During the assessment period, Internal Audit's review identified instances of non-compliance with margin parameter review frequencies required by ASX's own policies, as well as the need to update some of the model documentation; ASX management has commenced remediating these issues.

At the Bank's request, ASX's Model Validation Standard requires that margin models are to be assessed annually against industry best practice; however, ASX is yet to carry out the first of these reviews. ASX anticipates the first review will be conducted in the next assessment period. ASX should also take into consideration international best practice as part of its ongoing margin model review program (see section 3.3.2).

3.9.4 Transparency

Transparency helps participants understand and manage their risks from participation in the CCPs and enables more effective user governance by providing an external source of expert challenge on the CCPs' margin models.

ASX makes a range of margin-related information available to its participants, including quarterly backtesting results, current margin parameter files and web-based tools used by participants to estimate requirements. However, participants currently do not receive results from ASX's sensitivity analysis or its annual independent model validations, nor do they receive detailed information on ASX's use of expert judgement to override its model outputs when determining margin requirements. The Bank has previously highlighted the need for the ASX CCPs to ensure that their disclosure arrangements address all relevant aspects of their risk management frameworks, and will discuss the gaps identified above in the context of this recommendation.

Recommendation: To align financial risk management practices and governance arrangements with the CCP Resilience Guidance, the ASX CCPs should continue to implement plans to: […] ensure that their arrangements for disclosure to, and soliciting feedback from, stakeholders cover all relevant aspects of the CCPs' risk management frameworks, including margin sensitivity analysis, reverse stress testing and management of procyclicality.

Footnotes

The Bank's supplementary interpretation of the FSS requires that the ASX CCPs use a 99.5% confidence interval for OTC products: RBA (2014), ‘Supplementary Interpretation of the Financial Stability Standards for Central Counterparties’, Email to ASX, 27 October. [13]

Volatility is calculated using an exponential decay factor (currently 0.97), which places greater weight on more recent observations. [14]

During the assessment period, ASX Clear increased the historical sample period for cash equities from two to five years. This resulted in 50 stocks (with price histories greater than two years, but less than five years) that were previously margined using the HSVaR model to be margined using flat rates. [15]

In 2019, CME announced that it had developed a new margin model using a VaR-based methodology (CME SPAN 2), which it expected to implement over a number of years. [16]

See guidance paragraph 3.1.2 to the CCP Standards. A CCP does not necessarily need to take a uniform margining approach across all products in order to achieve coherent and consistent risk outcomes. [17]

The futures products eligible for cross-product margining include: 30 day cash rate futures, 90 day bank bill futures, and 3, 5, 10 and 20 year bond futures contracts. [18]

The model seeks to minimise the initial margin requirements under the FHSVaR model, while not increasing the sum of FHSVaR and SPAN margin. The allocation of positions is theoretical for margining purposes only and no actual transactions take place. [19]

The Bank applies the CPMI-IOSCO CCP Resilience Guidance in interpreting CCP Standards 2, 3, 4, 5, 6, 7 and 14. [20]

This includes non-margin sources of procyclicality in CCP risk management models – for instance, where haircuts applied to collateral posted by participants are calibrated to increase in times of market stress. [21]

ASX Clear (Futures) had introduced floors for equity index futures and major interest rate futures contracts in the previous assessment period. [22]

The risk is heightened when ad hoc calls are made. [23]

Less frequent intraday margin calls imply a longer MPOR should be applied, since there is a longer potential period between the last variation margin call and the point at which a default can be closed out. [24]

ASX Clear's intraday ad hoc margin call consists of two parts: an additional initial margin (AIM) call based on estimated exposures, and a call for initial, premium and variation margin for ETOs only. The CHESS replacement system is expected to support calculation of intraday cash equity exposures, and the Bank is recommending that ASX Clear update its intraday margining approach to reflect this new capability (see section 0). [25]

For a participant to be included in the overnight margin call, it must meet certain exposure thresholds. [26]

The timing of the call means that participants cannot use Austraclear to make payments as they would during the Day Session. [27]

ASX has consulted participants on proposed changes to how the Recovery Rules allocate losses from a commercial settlement bank default related to overnight margin. Among other things, these changes would ensure that none of these losses are allocated to participants of ASX Clear. [28]

For example, ASX used last traded prices as the closing price following the outage affecting ASX Trade in November 2020. [29]

Margin floors are reviewed semi-annually and dollar PSRs at ASX Clear (Futures) are reviewed monthly. [30]

Contracts affected included the 30-day inter-bank cash rate futures (IB), 90-day bank accepted bill futures (IR) and 3-year Australian Government bond futures (YT). [31]

A similar outcome can be achieved by adjustments to margin settings, depending on the context (see section 3.4). [32]