Speech Recent Economic Developments

Thank you for the invitation to participate in this year's AFR Business Summit. It is very good to be with you again.

I would like to cover four issues today:

- The resilience of the Australian economy and some of the major uncertainties, including the invasion of Ukraine by Russia.

- The journey towards full employment in Australia.

- The recent inflation data.

- The implications of these developments for monetary policy in Australia.

The resilience of the Australian economy

Last week we received further evidence of the resilience of the Australian economy. In the December quarter, GDP increased by 3.4 per cent, which was one of the biggest quarterly increases on record. Over the final months of the year, there was a very strong bounce-back in household consumption following the mid-year Delta lockdowns. Over 2021 as a whole, the economy grew by 4.2 per cent, taking the level of GDP to 3½ per cent above its pre-COVID-19 level (Graph 1). This is a very good outcome by global standards, which is something we should not forget.

The data available so far for the March quarter suggest a continuation of positive growth, despite the setback caused by the Omicron outbreak. As COVID infection rates have declined, spending and hours worked have both bounced back quickly. The flooding in eastern Australia is causing severe disruptions in some areas at the moment, but GDP is expected to increase by around 4¼ per cent this year. This outlook is being supported by the opening of Australia's international borders, the substantial accumulation of savings by households over the past two years, a large pipeline of construction activity and ongoing support from macroeconomic policy.

Against this generally positive outlook, the main sources of uncertainty are COVID-19 – which is not yet behind us – and the tragic war in Ukraine. This war is first and foremost a catastrophic event in human terms, but it is also a new major risk to the global economy. It is difficult to know what the full implications are, but from today's viewpoint, the main economic effects stem largely from higher commodity prices. The most obvious of these is the price of gas in Europe, which has more than doubled since the start of February (Graph 2). Oil prices are also up by 40 per cent, as are thermal coal prices. The prices of many base metals, including nickel and aluminium, are also up sharply. The prices of agricultural commodities have also been affected, with the price of wheat in global markets up by 40 per cent since the start of February.

For the countries in Europe, this rise in commodity prices represents a negative shock to their terms of trade and thus to their national income. This alone will cause a slowdown in economic activity. It will also cause CPI inflation to be higher than it would have otherwise been.

Australia is in a different position because we export many of the commodities whose prices are rising. This means that our terms of trade will rise over the months ahead, which will provide a boost to our national income. This boost is likely to be evident mainly in the form of higher profits for companies in the resources sector and higher tax revenue. At the same time, the rise in global oil prices is causing higher petrol prices at the bowser. This will eat into household budgets, push up costs for many businesses and crimp spending in some areas. Given this, I expect that most of this extra national income will be saved, rather than flow through into higher spending.

Looking beyond the impact on commodity markets, the war in Ukraine poses other significant downside risks for the global economy. From both a humanitarian and economic perspective, there is a lot riding on how events develop here.

The journey towards full employment

I would now like to turn back to the more positive story – that is the resilience of the Australian economy, which is especially evident in the labour market. At the start of last year, our central forecast was that the unemployment rate would now be at 6 per cent. Yet over recent months, the unemployment rate has been 4.2 per cent and underemployment has fallen to the lowest rate in more than a decade (Graph 3).

We expect this improvement in the labour market to continue. There was, however, a setback in January, with total hours worked in Australia declining by nearly 9 per cent, as many people isolated due to Omicron and others took holidays that had been put off last year. Looking forward, the high level of job vacancies and the information from our business liaison program both suggest that there will be strong growth in hours worked and the number of jobs over the months ahead.

Our central forecast is that the unemployment rate will fall to below 4 per cent over the course of this year and remain there next year. The last time that the unemployment rate was that low was almost half a century ago (Graph 4). If we reach this milestone, it would be a significant achievement.

This raises the question of what constitutes full employment in Australia in the early 2020s. We don't have a predetermined answer here – we are being guided by the evidence, particularly the outcomes for wages and prices. There is a lot of uncertainty surrounding estimates of the Non-Accelerating Inflation Rate of Unemployment (NAIRU), and our estimates have trended lower over recent years as more evidence has become available. I hope, and expect, that a period of sustained economic growth can further lower estimates of the unemployment rate associated with full employment. But time will tell.

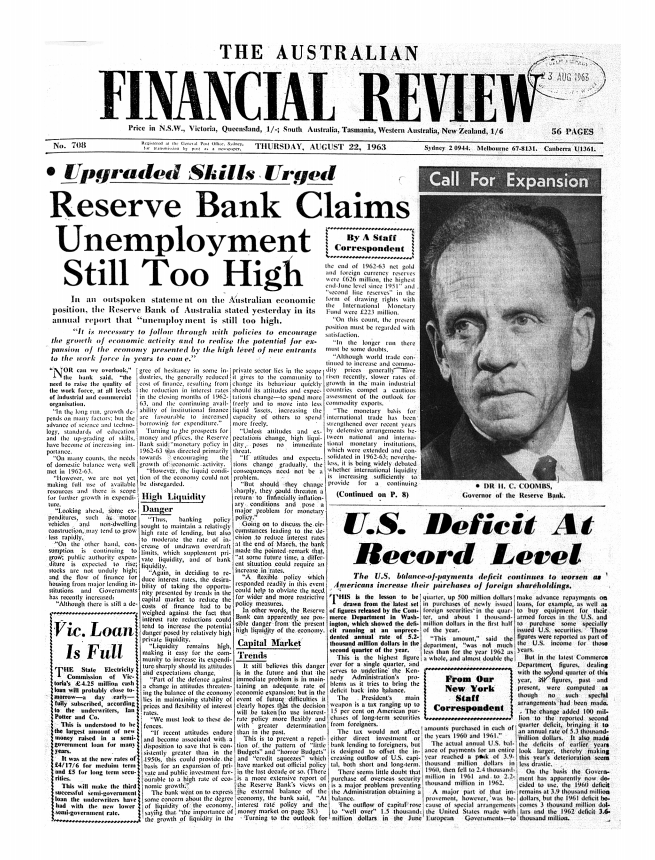

I was reminded of the changing nature of full employment last year when Michael Stutchbury, the editor-in-chief of the Australian Financial Review (AFR), sent me a copy of the front page of the AFR published back on 22 August 1963 – nearly 60 years ago (Figure 1). On that day, the paper led with the headline ‘Reserve Bank Claims Unemployment Still Too High’. At the time, the unemployment rate was just 2 per cent! Reading the AFR from 1963 served as a reminder that what we consider as achievable changes over time, and is influenced by the structural features of our economy. It was also a reminder that the RBA has long had a focus on full employment, which is one of our three broad objectives set out in the Reserve Bank Act 1959.

The AFR's headline was prompted by the introduction to the RBA's 1963 Annual Report, which was released the day before. From today's perspective, that introduction is remarkable in that it does not mention the word ‘inflation’ or the CPI, but just has a vague reference to the notion of price stability. The final sentence of that introduction, though, is more timeless. It is just as relevant today as it was back 60 years ago when it was written. That final sentence reads:

‘In the longer-run, growth depends on many factors; but with the advance of science and technology, standards of education and the up-grading of skills have become of increasing importance.’

These words from the past serve as a timely reminder that science, education and the development of skills are key to our future prosperity and rising real incomes. As Australia charts its way back to full employment, it would be wise to keep this counsel from 1963 in mind. Investment in these areas will also help build the resilience that we need to guard against future shocks, wherever they come from.

Inflation

I would now like to move to the other issue of the day – and that is inflation.

After many years in which concerns about high inflation were at the periphery of the radar screen, they have now moved to the centre in a number of countries. This is especially so in the United States, where the CPI increased by 7½ per cent over the year to January, which is the fastest rate in 40 years. Inflation rates in the United Kingdom, Germany, Canada and New Zealand are also at their highest in decades (Graph 5).

Rightly, this increase in inflation is receiving a lot of attention. It is important, though, to recognise that inflation rates in much of Asia remain low and not much different from before the pandemic. In China, CPI inflation is running at just 0.6 per cent and in Japan it is 0.5 per cent.

Australia sits somewhere in the middle, but closer to the experience in Asia. Headline inflation here is 3½ per cent, less than half the rate in the United States. In underlying terms, inflation is running at 2.6 per cent. This is the first time in more than seven years that it has been above the midpoint of medium-term 2 to 3 per cent target band.

There are a few factors that explain this difference with the United States. I would like to mention three of these.

The first is the different developments in the gas and electricity markets. In the United States, household gas prices are up by nearly 25 per cent over the past year and electricity prices are up by more than 10 per cent (Graph 6). In contrast, the prices that Australian households pay for energy have risen only modestly. Our gas and electricity markets are not closely connected with those in the rest of world and the increased capacity from wind and solar generators has put downward pressure on wholesale electricity prices.

A second factor is the different behaviour of goods prices. In the United States, goods prices (excluding energy) are up by 9 per cent over the past year. In Australia, they are up by 3 per cent (Graph 7). In the United States, there was a very strong surge in demand for goods during the pandemic and firms had trouble meeting this due to supply-chain problems and, in some areas, a shortage of workers. The result has been a big increase in prices. The same general dynamic has been at work in Australia, but the surge in demand for goods has been less pronounced here and the pandemic has not had the same effect on the availability of workers.

A third and more enduring factor is the different trends in labour costs. In the United States, and the United Kingdom, wages are rising much more quickly than they were previously (Graph 8). In contrast, in Australia, but also in Japan and some European countries, wages are increasing at a similar rate to before the pandemic. One factor contributing to these differing experiences is the different trends in labour force participation. In the United States and the United Kingdom, labour force participation is still below its pre-pandemic level. In contrast, in Australia, we are near record highs in terms of participation. The JobKeeper program helped workers remain attached to their employers during the pandemic and this has helped the labour market recover with fewer strains than in the United States. It is worth noting that participation rates have also recovered in many Asian nations, including Japan.

The point I want to make here is that while there is a common thread to inflation stories across many economies, there are important differences as well. These differences are relevant to the setting of monetary policy, to which I will now turn.

Monetary policy

Now that the bond purchase program, the yield target and the provision of new funding under the Term Funding Facility have come to end, the focus of the Reserve Bank Board's monthly monetary policy decisions has once again returned to the level of the cash rate.[1]

Since the onset of the pandemic, the Board has said that it will not increase the cash rate until inflation is sustainably in the 2 to 3 per cent target range. It has indicated that it wants to see evidence that inflation will be sustained in this range, rather than simply be forecast to do so. This focus on outcomes and evidence reflects both the uncertain times we are living in, which has made forecasting more difficult than usual, and the persistent undershooting of the inflation target over earlier years.

The recent lift in inflation has brought us closer to the point where inflation is sustainably in the target range. So too have recent global developments. But we are not yet at that point. In underlying terms, inflation has just reached the midpoint of the target band for the first time in over seven years. And this comes on the back of very large disruptions to supply chains and distribution networks, some of which are still expected to ease. It also comes at a time when aggregate wages growth is no higher than it was before the pandemic, which was associated with inflation being persistently below target.

In these circumstances, we have scope to wait and assess incoming information and see how some of the uncertainties are resolved. We can be patient in a way that countries with substantially higher rates of inflation cannot.

There are two issues, in particular, that we are paying close attention to. The first is the persistence of supply-side price shocks and the extent to which developments in Ukraine add to these supply-side inflation pressures. The second is how labour costs in Australia evolve.

Prior to the war in Ukraine, there was some evidence that the supply-side issues in the global economy were gradually being resolved (Graph 9). Delivery times had shortened a bit, global car production was increasing again and the prices of semiconductors had come off their peaks. Businesses were also responding with new investment and changes in processes to ease capacity constraints. These developments were providing a basis for expecting that supply-side inflation pressures would ease over time, both globally and here in Australia.

But, now, the war in Ukraine and the sanctions against Russia have created a new supply shock that is pushing prices up, especially for commodities. This new supply shock will extend the period of inflation being above central banks' targets. This runs the risk that the low-inflation psychology that has characterised many advanced economies over the past two decades starts to shift. If so, the higher inflation would be more persistent and broad-based, and require a larger monetary policy response. At the moment, financial market pricing suggests that CPI inflation will decline from its current high rates in the North Atlantic economies to around 2 per cent without real interest rates ever going into positive territory. A shift in inflation psychology would challenge this view, so this is a critical issue.

The second issue we are watching closely is the evolution of domestic labour costs. The latest data confirmed that aggregate wages growth remains modest. The Wage Price Index (WPI) increased by 2.3 per cent last year, with the broader measure including bonuses increasing by 2.8 per cent (Graph 10). The national accounts measure of average hourly earnings increased a bit faster than this at 3.3 per cent. This measure is more volatile than the WPI as it captures changes in the composition of employment, which have been large during the pandemic. There are certainly pay rises that are much larger than 3 per cent taking place for some jobs, but the evidence is that most working Australians are still experiencing base wage increases of no more than 2-point-something per cent. This is also consistent with what we are hearing through our business liaison program.

The RBA's central forecast is for growth in aggregate labour costs to pick up further as the labour market tightens. This pick-up is likely to be gradual, though, given the multi-year enterprise agreements, the annual review of award wages and public sector wages policies.

There are, however, uncertainties about the future growth of labour costs. This is partly because we have no contemporary experience of a national unemployment rate below 4 per cent. The closest experience we have is that in the years leading up to the pandemic some of the larger states had unemployment rates around 4 per cent and wages growth hardly moved. It is also unclear, at this stage, what effect the opening of the international borders will have on the balance between supply and demand in the labour market. There is also the question of how wages respond to the current higher rates of headline inflation. There is a risk if these higher inflation rates are sustained as a result of a sequence of negative supply shocks, that wages growth picks up more quickly than forecast as workers seek compensation for the higher inflation.

In this uncertain environment – and with the starting points for wages growth and underlying inflation in Australia – we can take the time to assess the incoming information and review how the uncertainties are resolved. Given the outlook, though, it is plausible that the cash rate will be increased later this year.

I recognise that there is a risk to waiting too long, especially in a world with overlapping supply shocks and a high headline inflation rate. But there is also a risk of moving too early. Australia has the opportunity to secure a lower rate of unemployment than has been the case for some decades. Moving too early could put this at risk. There are benefits to the economic welfare of Australia of a period of relatively steady growth in which people get jobs, have training and develop skills. This is one path to sustaining a lower unemployment rate than was thought possible just a short while ago – not as low as was thought possible back in 1963, but lower than was thought possible just five years ago.

I want to finish with the point that it is only possible to achieve a sustained period of low unemployment if inflation remains low and stable. Recent developments in Europe have added to the complexities here. The Reserve Bank will respond as needed and do what is necessary to maintain low and stable inflation in Australia.

Thank you for listening and I am happy to answer questions.