Banks' Funding Costs and Lending Rates

Download the complete Explainer 207KBBanks' funding costs and lending rates are an important part of the transmission of monetary policy to economic activity and ultimately inflation (see Explainer: The Transmission of Monetary Policy). The interest rates that banks charge borrowers and pay to savers influence the decisions of businesses and households about how much they want to borrow or save. To fully understand the transmission of monetary policy, it is important to understand what banks' funding costs and lending rates are, and what influences them.[1]

What are Banks' Funding Costs and Lending Rates?

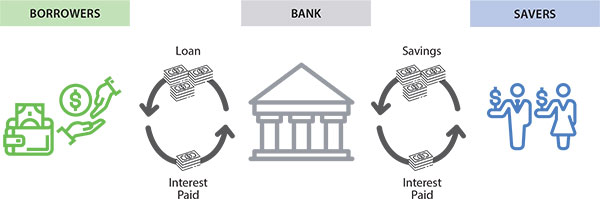

Banks collect savings from households and businesses (savers) and use these funds to make loans to those who want to borrow (borrowers). Banks must pay interest on the funds that they collect from savers, which is one of their main funding costs. On the other hand, banks receive interest from loans that they make to borrowers and this is a large part of their revenue. From the perspective of a bank:

- funding costs are the interest rates paid to savers

- lending rates are the interest rates paid by borrowers.

How do Banks Fund Themselves?

Banks collect funds from savers in various ways. Deposits from Australian households and businesses account for around two-thirds of Australian banks' total funding. Banks can also collect funds from savers by issuing bonds and other debt securities in financial markets, which account for around a third of Australian banks' funding. Other sources of funding like equity – for example, banks' shares listed on the share market – represent the remainder of banks' funding. (For updated data on the composition of funding for banks in Australia, see the Reserve Bank's monthly Chart Pack.)

What Influences Banks' Funding Costs?

The cash rate

The cash rate has an important role in determining the interest rates on banks' funding sources. However, the interest rates banks pay for different sources of funding don't necessarily move by the same amount or at the same speed as a change in the cash rate.

Market reference rates

Changes in the cash rate are typically transmitted quickly to an important group of interest rates called ‘market reference rates’. Market reference rates are based on transactions between participants in a financial market that happen often enough to reliably measure these rates. Because market reference rates are reliably measured, they are often used as a benchmark for pricing bonds and other debt securities, including those issued by banks. An example of an important market reference rate for bank funding costs is the bank bill swap rate (BBSW).

Deposit rates

Deposit rates are less directly influenced by the cash rate and changes to the cash rate also tend to take some time to be transmitted to deposit rates. This is because banks have discretion in setting deposit rates and also because deposit rates are influenced by other factors. For example, banks may raise deposit rates, independently of a change in the cash rate, to attract more deposits. Banks might wish to hold more deposits because they are considered more stable than some other sources of funding.

Other monetary policy tools

Other monetary policy tools can also have implications for banks' funding costs (see Explainer: Unconventional Monetary Policy).

Extended liquidity operations: term funding schemes

Term funding schemes allow banks to borrow funding from the central bank at a low cost for an extended period. These schemes aim to lower banks' funding costs and provide funding that is stable, particularly in times of economic distress where the cash rate may have also reached its lowest practical level. For instance, in Australia the Term Funding Facility (TFF) was announced in March 2020 during the COVID-19 pandemic (see Box below on ‘The Term Funding Facility’).

Policies that influence the slope of the risk free yield curve: asset purchases and forward guidance

The risk free yield curve influences market reference rates for some sources of bank funding. Consequently, policies that influence its slope, such as asset purchases and forward guidance, may flow through to bank funding costs (see Explainer: Bonds and the Yield Curve).

Other factors that influence funding costs

A variety of other factors can also influence bank funding costs without any change in the stance of monetary policy in Australia. These include:

- demand for or supply of different types of funding, for instance more competition among banks to attract deposit funding typically results in higher deposit rates

- the compensation required by savers to invest in bank debt.

What influences banks' lending rates?

Banks set their lending rates to maximise the profitability of lending, subject to an appropriate exposure to the risk that some borrowers will fail to repay their loans. Banks measure the profitability of lending as the difference between the revenue the bank expects to receive from making the loans and the cost of funding loans. Factors that affect the profitability of lending will in turn influence where a bank decides to set its lending rates.

Banks' funding costs

Funding costs will influence where a bank sets lending rates. When funding costs change, the response of lending rates will depend on the expected impact on a bank's profits. If funding costs increase, then a bank may wish to increase lending rates to maintain its profits. However, borrowers may seek to borrow less if lending rates are higher. If this were to occur, then the bank would see less demand for loans and this could reduce its profits. A bank must balance these considerations in deciding how to set lending rates.

Competition for borrowers

If borrowers are seeking to borrow less funds than banks want to lend, then banks will have to compete to attract borrowers and maintain their profits. All else equal, a higher degree of competition among banks to attract borrowers typically results in lower lending rates.

The risk that borrowers do not repay their loans

For each loan that it makes, a bank will assess the risk that a borrower does not repay their loan (that is, the credit risk). This will influence the revenue the bank expects to receive from a loan and, as a result, the lending rate it charges the borrower. If a bank considers that it is more likely to lose money from a credit card loan than from a home loan, then the interest rate on a credit card loan will be higher than for a home loan. A bank's perception of these risks can change over time and influence their appetite for certain types of lending and, therefore, the interest rates they charge on them.

Box: The Term Funding Facility

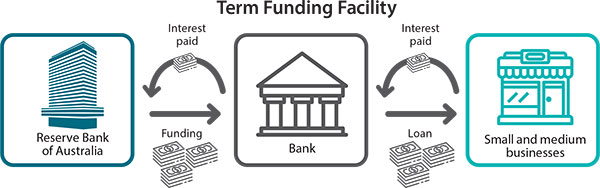

The Reserve Bank announced the Term Funding Facility (TFF) in March 2020 along with several other monetary policy measures designed to help lower funding costs in the Australian banking system.

The TFF made a large amount of funding available to banks at a very low interest rate for three years. Funding from the TFF was much cheaper for banks than other funding sources available at the time it was announced. (See announcement of Term Funding Facility and the Governor's speech Responding to the Economic and Financial Impact of COVID-19.)

The TFF was designed to lower banks' funding costs and in turn to reduce lending rates for borrowers. The TFF also created an incentive for banks to lend to businesses (particularly small and medium-sized businesses). This was because banks could borrow extra funding under the TFF if they increased their lending to businesses: for every dollar of extra lending to small- or medium-sized business, banks could access five dollars of extra funding under the TFF (for large businesses, the amount was one dollar of extra funding).[2]

Endnotes

Learn more in the annual Bulletin article on Developments in Banks' Funding Costs and Lending Rates (2023). [1]

See the Bulletin article on ‘The Term Funding Facility’ for more information. [2]