Gold Audit Summary Report June 2022

- Download the Gold Audit Summary 220KB

1. Executive summary

The existence and accuracy of the Reserve Bank of Australia's (RBA) gold holdings were verified by RBA Audit in April 2022. All gold bars selected were satisfactorily verified with no discrepancies or inconsistencies identified during the weighing checks. Also, the gold safe custody arrangements and segregation of duties at the Bank of England (BoE) appear appropriate.

This physical verification of the RBA's gold bar holdings at the BoE follows previous audits in 2013 and 2019. No issues have been identified in this audit or previous audits.

2. Background

The RBA holds 2.5674 million fine troy ounces (FTO) of gold valued at AUD6.87 billion as at 30 April 2022. Almost all of the RBA's physical holdings are stored in the United Kingdom at the BoE, a few bars (four) are stored at the RBA's Sydney Holding Point (SHP). A small share of the RBA's holdings are used for gold swaps and/or lent to carefully selected counterparties. See Table 1 below for details. All bars that are delivered into the RBA's account at the BoE must meet the standards for ‘Good Delivery’[1] set by the London Bullion Market Association (LBMA). This includes the list of acceptable refiners of gold bars in the London bullion market, technical specifications of bars, quality assurance provisions, and compliance and risk management rules.

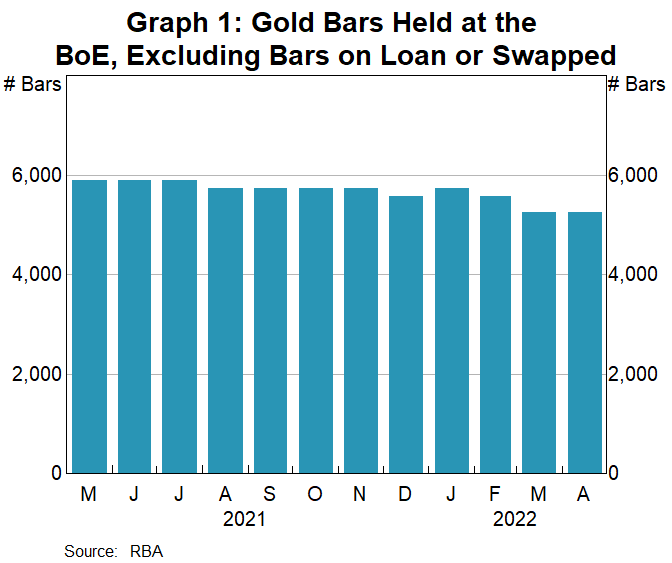

Changes in the number of gold bars the RBA holds at the BoE are shown in Graph 1. The changes reflect both new and maturing gold loans and swaps. Earnings from gold lending activity amounted to $1.3 million in the 2020/21 financial year.

| Million FTO | AUD million | |

|---|---|---|

| Held with the BoE | 2.1166 | 5,660 |

| Sydney Holding Point | 0.0016 | 4 |

| Swap(a) | 0.2560 | 685 |

| Loan(b) | 0.1932 | 517 |

|

(a) Out of scope of this audit. Gold swaps vis-à-vis USD, CAD, EUR, GBP,

JPY and AUD for managing foreign currency reserves or implementing domestic liquidity

operations. Gold forward positions have a maximum term-to-maturity of 100 days.

|

||

3. Objective

The objective of the audit was to verify the RBA's gold holdings at the BoE and SHP and to obtain a high level overview of the gold safe custody arrangements at the BoE.

4. Observations and findings

BoE holdings

The RBA had a total of 5,264 bars as at 11 April 2022 held at the BoE (the first day Audit was on-site). The physical verification of gold bars was performed by carefully examining a sample of 460 bars, being 8.74 per cent of the RBA's holdings. The sample was chosen using random sampling, which gave each bar an equal chance of being selected. The sample comprised a pre-identified selection of bars and a sample selected on-site.

As part of this audit, Audit also observed and was provided with a high level overview of the BoE's gold safe custody arrangements, segregation of duties and physical security arrangements, with no issues noted.

Pre-identified sample

A random sample of 450 bars (8.55 per cent of the RBA's holdings) were selected by Audit and notified to the BoE prior to Audit's arrival on-site, hence the location and retrieval from the vaults was not witnessed. The sample selected involved gold bars held by the RBA that had been produced by a wide range of refiners. Audit physically verified each of the sampled gold bars, confirming the refiner's identification, the refiner number, the gold assay rating and the BoE number.

A subset of 50 bars (11 per cent of the pre-identified sample) were weighed. Weighing was performed by BoE staff using their equipment with Audit present.[2] These checks confirmed that the weight of the gold bars was consistent with the details on the listing (within an acceptable tolerance of ±0.025 fine ounces, which is in line with the LBMA Good Delivery List Rules).

On-site sample selection

A further 10 bars were selected upon Audit's arrival at the BoE, this sample was not provided nor disclosed to the BoE prior to the visit. Audit was escorted to physically verify each of these bars within the BoE's gold vaults. All of these bars were weighed by BoE staff using their equipment with Audit present.

No discrepancies were identified between the RBA's gold listing and these 10 gold bars Audit sampled in this way.

Sydney Holdings Point

The RBA holds four gold bars at SHP. Audit sighted the gold bar details, including the assay rating, the bar numbers and the refiner's identification. No issues were noted. The weight of these gold bars is checked every five years. The last verification on 7 June 2019 confirmed the gross weight of each of the four bars. The next verification check is due in 2024.

5. Conclusion

Based on the procedures performed at the BoE:

- All gold bars selected (460 bars) were satisfactorily verified by Audit confirming the refiner's identification, the refiner number, the assay rating and the BoE bar number.

- No discrepancies or inconsistencies were identified during the weighing check (of the 50 bars pre-identified and the 10 bars selected on-site). In line with the LBMA Good Delivery List Rules, the gross weights of the bars is expressed in multiples of 0.025, rounded down to the nearest 0.025 of a troy ounce.

- Based on Audit's observations and discussions, the gold safe custody arrangements, segregation of duties and physical security arrangements at the BoE are appropriate.

Audit also sighted the four gold bars stored at SHP. No issues were noted.

Appendix A: Sample summary by refiner

| Refiner | Bars held | Bars sampled | % of refiner bars sampled |

|---|---|---|---|

| AGR Joint Venture | 92 | 8 | 9% |

| AGR Matthey Newburn | 104 | 6 | 6% |

| AGR Perth Newburn | 40 | 5 | 13% |

| Allgemaine Gold-und Silberscheideanstalt AG | 5 | 1 | 20% |

| Almalyk Mining & Metallurgical Complex (Uzbekistan) | 19 | 0 | 0% |

| AngloGold Ashanti Mineracao Ltd | 88 | 10 | 11% |

| Argor-Heraeus S.A | 133 | 7 | 5% |

| Asahi Refining Canada Limited | 604 | 61 | 10% |

| Asahi Refining USA inc | 236 | 18 | 8% |

| Aurubis AG | 12 | 1 | 8% |

| Australian Gold Refineries – Kalgoorlie | 11 | 1 | 9% |

| Banco Ourinvesta SA Brazil | 1 | 0 | 0% |

| Boliden Mineral A.B. | 24 | 1 | 4% |

| Canadian Copper Refiners ltd Montreal | 123 | 9 | 7% |

| Central Bank of the Philippines Gold Refinery and Mint | 53 | 4 | 8% |

| Chimet SpA | 3 | 0 | 0% |

| Degussa SA Brasil | 4 | 0 | 0% |

| Engelhard Ltd | 1 | 0 | 0% |

| Engelhard SA | 3 | 1 | 33% |

| Federal State Enterprise Novosibirsk Refinery(a) | 5 | 0 | 0% |

| Fidelity Printers and Refiners (Private) Ltd | 4 | 2 | 50% |

| Heraeus Ltd, Hong Kong | 62 | 5 | 8% |

| IGR (Istanbul Gold Refinery) | 28 | 4 | 14% |

| Ital preziosi Italy | 9 | 0 | 0% |

| Johnson Matthey & Co Ltd | 107 | 12 | 11% |

| Johnson Matthey and Mallory Ltd. Toronto | 364 | 22 | 6% |

| Johnson Matthey Chemicals Ltd | 99 | 10 | 10% |

| Johnson Matthey Hong Kong Ltd | 27 | 2 | 7% |

| Johnson Matthey ltd, Australia | 23 | 2 | 9% |

| Johnson Matthey Salt Lake City USA | 315 | 29 | 9% |

| JSC Kara-Balta Mining Combinate (KMC) – Kyrgyz Republic | 63 | 8 | 13% |

| JSC Kolyma Refinery(a) | 4 | 1 | 25% |

| JSC Krasnoyarsk Non-Ferrous Metals Plant(a) | 57 | 8 | 14% |

| JSC Uralectromed Russia(a) | 5 | 0 | 0% |

| KazzInc Joint Stock Company | 4 | 0 | 0% |

| Metalor Hong Kong Kwai Chung | 72 | 7 | 10% |

| Metalor Singapore | 3 | 0 | 0% |

| Metalor Technologies SA (Switzerland) | 11 | 2 | 18% |

| Metalor USA | 95 | 4 | 4% |

| Met-Mex Penoles, SA | 111 | 10 | 9% |

| Mineracao Morro Velho S.A. | 1 | 0 | 0% |

| Mitsubishi Materials Corporation | 24 | 0 | 0% |

| N M Rothschild & Son Ltd | 4 | 1 | 25% |

| Nadir Metal Refinery Gold, Bahcelievler Turkey | 15 | 3 | 20% |

| Navoi Mining & Metallurgical Combinat | 65 | 6 | 9% |

| Nippon Mining and Metals'Sagonoseki Plant, Japan | 2 | 0 | 0% |

| Norddeutsche Affinerie Aktiengesellschaft | 6 | 1 | 17% |

| PAMP SA | 136 | 6 | 4% |

| Perth Mint Newburn | 183 | 18 | 10% |

| Prioksky Plant of Non- Ferrous Metals(a) | 26 | 1 | 4% |

| Rand Refinery Ltd | 764 | 66 | 9% |

| Royal Canadian Mint | 239 | 13 | 5% |

| Royal Mint (Melbourne) | 4 | 1 | 25% |

| Royal Mint Perth | 69 | 6 | 9% |

| S.E.M.P. S.A. | 29 | 3 | 10% |

| SC Phoenix SA Baia Mare | 2 | 1 | 50% |

| Sichuan Tianze Precious Metals Co | 3 | 0 | 0% |

| Societe Gererale Metallurgique de Hoboken | 6 | 2 | 33% |

| State Refinery (Moscow)(a) | 147 | 14 | 10% |

| Tanaka Kikinzoku Kogyo KK | 159 | 19 | 12% |

| TCA Precious Metals Refining | 9 | 0 | 0% |

| The Sheffield Smelting Co Ltd | 1 | 0 | 0% |

| U.S. Assay Offices and Mints Denver | 1 | 1 | 100% |

| U.S. Assay Offices and Mints NEW YORK | 141 | 14 | 10% |

| U.S. Assay Offices and Mints San Francisco | 1 | 0 | 0% |

| Umicore Brasil Ltda Guarulhos Sao Paulo | 6 | 0 | 0% |

| Umicore Feingold Netherlands | 2 | 1 | 50% |

| VALCAMBI | 93 | 12 | 13% |

| Valcambi, S.A. | 102 | 10 | 10% |

| Total | 5,264 | 460 | 8.74% |

|

(a) All bars produced by Russian refiners were refined prior to 2022. |

|||

Endnotes

See LBMA (2022), ‘Good Delivery Rules’, January. Available at <https://www.lbma.org.uk/publications/good-delivery-rules>. [1]

The Service Report from an independent provider was obtained, confirming the condition of the specific gold bullion scale used for weighing. Audit confirmed that the equipment is independently calibrated on a regular basis; the most recent independent check was in January 2022. [2]